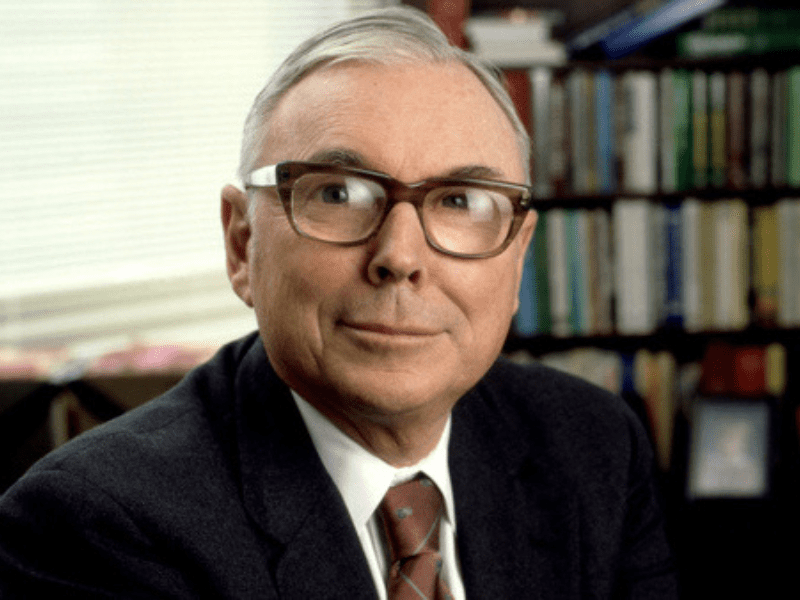

The recent passing of Charlie Munger at the age of 99 has left an indelible void in the world of finance. As Warren Buffett’s trusted partner and the sage mind behind Berkshire Hathaway, Munger’s legacy extends far beyond his remarkable lifespan. This comprehensive exploration aims to unravel the most crucial investing lesson imparted by Munger – the profound importance of investing exclusively in high-quality businesses.

We will delve into the evolution of Munger’s philosophy, its impact on Warren Buffett’s investment approach, and practical insights for identifying wonderful companies in today’s intricate investment landscape.

High-Quality Stocks Compound Best

Charlie Munger’s influence on Warren Buffett’s investment approach is a story of transformation. When the two visionaries first crossed paths in 1959, Buffett was entrenched in classic value investing, focusing on undervalued companies. Munger, however, steered Buffett towards a more refined path – advocating for investments in high-quality businesses at a fair price.

A testament to this shift is Berkshire Hathaway’s acquisition of See’s Candies in 1972. Munger’s persuasion led Buffett to deviate from the traditional emphasis on cheap prices, instead prioritizing quality.

The result: See’s Candies, purchased for $25 million, has generated over $2 billion in pre-tax earnings. This landmark investment not only delivered substantial returns but also instilled in Buffett the transformative power of quality, shaping his future decisions, such as the strategic investment in Coca-Cola

Munger’s Fundamental Principle

At the heart of Munger’s investing philosophy lies a fundamental principle that echoes through the corridors of financial wisdom. Munger distilled this principle with simplicity and clarity, asserting that the long-term performance of a stock aligns closely with the underlying business’s profit trajectory. The essence of this principle is grounded in the idea that highly profitable companies with enduring competitive advantages consistently yield above-average returns on capital.

Regardless of short-term market fluctuations in valuation, a fundamentally strong and growing company will eventually be recognized and rewarded by the market. This principle emphasizes the importance of a patient, long-term approach to investing, aligning with Munger’s own penchant for very long holding periods.

How to Find Wonderful Companies

Identifying high-quality compounders, as championed by Munger, requires strategic screening and a keen eye for enduring excellence. Investors can leverage various tools, including stock screeners provided by online brokers or dedicated financial websites. Criteria such as profitability metrics and indicators of balance sheet strength become invaluable in the quest for wonderful companies.

Additionally, services like Morningstar, equipped with analysts specializing in different sectors, assign Economic Moat scores to individual companies.

Munger’s preference for ‘wide moat’ firms, characterized by enduring strategic attributes, resonates in Morningstar’s assessments. These companies consistently earn above-average returns on capital, reflecting their exceptional quality and ability to withstand market dynamics.

Opportunities to invest in wonderful companies may arise when short-term uncertainties or market misinterpretations temporarily affect their valuations. Munger’s approach encourages investors to seize these opportunities and patiently wait for the market to recognize the intrinsic value of these exceptional businesses.

The Pitfall of Ignoring Fundamentals

Munger’s teachings find profound relevance when contrasting scenarios, such as the meme stock mania that saw AMC Entertainment’s meteoric rise and subsequent fall. The misallocation of capital into low-quality companies, exemplified by AMC’s financial struggles, serves as a cautionary tale.

Munger’s wisdom becomes a safeguard against the pitfalls of overlooking a company’s intrinsic value in the pursuit of short-term gains.

The meme stock mania, characterized by aggressive bidding on companies like AMC, showcased the perils of ignoring fundamental principles. While the price of AMC shares soared to unprecedented heights, the company’s underlying fundamentals remained weak.

AMC Entertainment, having lost money every year since 2020 and facing operational challenges, became a symbol of speculative excess rather than a high-quality compounder. In retrospect, Munger’s emphasis on prioritizing business fundamentals emerges as a guiding principle, steering investors away from investments lacking enduring quality.

Fundamental Investing in Today’s Landscape

In a landscape dominated by algorithms, sophisticated analyses, and rapid market movements, Munger’s emphasis on high-quality businesses stands resilient. The simplicity of Munger’s mental model remains a beacon for investors navigating the complexities of modern financial markets.

Munger’s unwavering commitment to business fundamentals serves as a timeless guide, directing investors away from common pitfalls and towards sustainable wealth creation.

The enduring relevance of Munger’s teachings is evident in their applicability to contemporary challenges and opportunities. As investors navigate a landscape shaped by technological advancements and information overload, Munger’s emphasis on enduring quality offers a compass for sound decision-making.

In an era where market sentiments can sway rapidly, Munger’s timeless wisdom serves as a stabilizing force, reminding investors to prioritize quality over short-term gains.

Charlie Munger’s departure from the physical realm marks the end of an era, but his legacy lives on in the enduring wisdom he bequeathed to the investment world. The most crucial lesson gleaned from Munger’s illustrious career revolves around the transformative power of investing in high-quality businesses.

As we reflect on Munger’s profound influence on Warren Buffett’s investment philosophy, it becomes evident that the pursuit of enduring quality is a timeless endeavor.

Investors are encouraged to embrace Munger’s teachings, prioritize quality over short-term gains, and unlock the secrets of compounding wealth through investments in wonderful companies. In a financial landscape marked by volatility and complexity, Munger’s legacy serves as a guiding light, steering investors towards the path of sustainable and long-term wealth creation.

Also Read the News Article: Charlie Munger’s Legacy: Five Key Investment Principles