What is Personal Finance?

Managing one’s own and family’s money, including debt management, investing, saving, and budgeting, is called personal finance. It is crucial since it eases people’s financial stress and worry and aids in money management and future financial planning.

Understanding the fundamental ideas and ideas of personal finance empowers people to manage their debt, savings, living expenditures, and retirement funds, as well as make wise financial decisions. Understanding all the avenues to achieve financial goals, such as investing, saving, managing debt, and retirement planning, is the essence of personal finance.

Table of Contents

The Importance of Personal Finance

A person’s ability to successfully manage their finances, make future plans, and attain financial security is what makes personal finance so important. Retirement planning, loan planning, budgeting, investing, and saving are just a few of the things it covers. To manage debt, build a financially secure future, and monitor one’s financial health, one must have a solid understanding of personal finance.

Along with protecting consumers from financial hazards, it also helps people to create and meet financial goals and make wise investment decisions. People can enhance their overall financial well-being and work towards a more secure and pleasant future by improving their financial literacy and engaging in effective personal finance management.

- Creating a Monthly Budget

- Tracking Expenses and Identifying Areas for Improvement

- Setting Realistic Financial Goals

- Saving and Investing Strategies

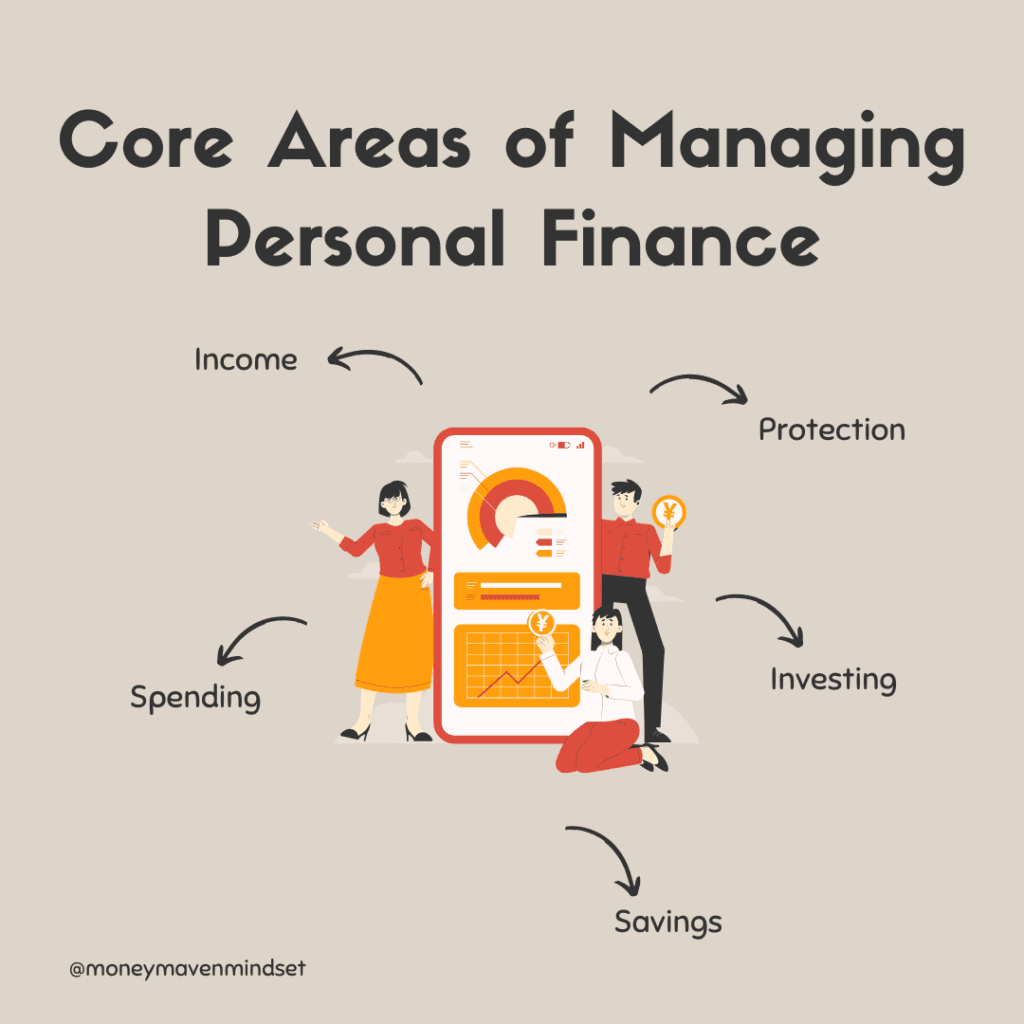

Core Areas of Managing Personal Finance

Key components of personal financial management consist of:

1. Income: The overall amount of money that you receive, including government benefits, investments, earnings from employment, and earnings from self-employment.

2. Spending: Using revenue to cover wants and necessities on a daily basis. Keeping costs under control and recognizing the difference between discretionary and non-discretionary spending are essential for effective spending.

3. Savings: Putting money aside for unforeseen expenses, big expenditures, or retirement. It’s crucial to accumulate a sufficient emergency fund.

4. Investing: Buying assets like stocks, bonds, real estate, or mutual funds that are anticipated to yield a rate of return. The long-term goal of investing is wealth growth.

5. Protection: Using insurance, legal papers, and other safeguards to protect against monetary hazards. Life insurance, disability insurance, and property and casualty insurance are a few examples.

The foundation of efficient personal financial management is made up of these five categories, which interact and reinforce one another. Securing financial security and peace of mind requires developing skills that include budgeting, setting up an emergency fund, paying off debt, using credit cards responsibly, investing for retirement, and purchasing insurance.

How can I save money for a Down Payment, College, Wedding, Car, Retirement, or House?

1. Down Payment:

- Make sure you live within your means by creating a budget.

- Set aside some money each month for savings.

- A high-yield savings account or certificate of deposit (CD) could be an investment to think about.

- Examine other options such as gift deposits or crowdsourcing.

2. College Expenses:

- Create a Coverdell ESA or a 529 College Savings Plan in order to help with college expenses.

- Contribute, if you are able, to a Roth IRA.

- Look into grants, student loans, and scholarships.

- Encourage students to apply for part-time jobs and merit-based financial aid.

3. Wedding Expenses:

- Determine a reasonable budget by taking into account your financial status.

- Prioritise spending and eliminate wasteful spending.

- Evaluate rates from different vendors and strike agreements.

- Examine other options, such as going smaller for the ceremony or eloping.

4. Car Purchasing:

- Prior to purchasing a new car, ascertain your transportation requirements.

- Compute the entire cost of ownership rather than just the monthly installments.

- Be sure to compare trade-in values and financing possibilities.

- Think twice before buying a brand-new car in favour of a certified pre-owned or used one.

5. Retirement Planning:

- One way to prepare for retirement is to begin contributing as soon as possible to an IRA, 401(k), or other retirement plan.

- To take advantage of compound interest, increase contributions each year.

- To reduce risks, diversify your investments.

- To receive personalised advice, speak with a financial advisor.

6. House Ownership:

- Setting up an emergency fund to pay for relocation and closing charges.

- Create a solid credit history and keep your credit score elevated.

- Compare lenders and do some research on mortgage kinds.

- Count on paying property taxes and continuing upkeep.

How to Invest in Stocks, Real Estate, Bitcoin, Mutual funds, Gold or Index funds

1. Stocks:

- Do your homework on businesses and sectors before making an investment.

- For diversity, think about making investments in exchange-traded funds (ETFs) or index funds.

- Continually review your investments and make any necessary portfolio adjustments.

- For personal advice, think about consulting a financial professional.

2. Real Estate:

- Find out about property valuations and the local real estate market.

- Take into account making investments in rental homes or real estate investment trusts (REITs).

- Include the expense of ongoing upkeep and property taxes.

- Speak with an expert in real estate for advice.

3. Bitcoin:

- Learn about the hazards associated with the cryptocurrency market.

- Take into account making an investment in a Bitcoin investment trust or an exchange.

- Keep a close eye on your investments and be ready for market fluctuations.

- Take advice from a financial expert into consideration.

4. Mutual Funds:

- Learn about mutual funds and their many approaches to investing.

- Take into account investing in actively managed or inexpensive index funds.

- Keep a close eye on your investments and make any necessary portfolio adjustments.

5. Gold:

- Learn about the hazards and the gold market.

- Think about purchasing coins, exchange-traded funds (ETFs), or gold bullion.

- For advice, think about consulting a financial advisor.

6. Index Funds:

- Learn about index funds and their approaches to investing.

- Take into account investing in exchange-traded funds (ETFs) or inexpensive index funds.

How to become Debt-free or manage Debt

Here are some pointers for managing debt or being-debt-free in 2024

1. Evaluate your Debt:

- Compile a list of all of your debts, together with the balance due, interest rates, and dates of payment.

- Create a comprehensive debt management plan.

- Set payment schedules that work with your budget and prioritise your bills.

2. Set attainable objectives to become debt-free:

- Calculate the monthly amount you must pay down to become debt-free.

- Then, set reasonable targets.

3. Cut Overflow Expenses:

- Determine where you can cut back on spending and use the money you save to pay off debt.

4. Restructure your Debt:

- To make debt management easier and maybe save interest rates, think about possibilities like debt consolidation or balance transfers.

5. Make changes to your budget:

- Spend in line with your income and make debt repayments a top priority. These are expenses that cannot be avoided.

6. Apply the avalanche or snowball technique:

- Pay off smaller debts first for psychological gains (snowball approach) or arrange debts according to interest rate and pay off the ones with the highest rates first (avalanche method).

7. Find undiscovered sources of passive income:

- Discover the financial value of unused paid vacation days or possible revenue streams made available by employee benefits packages, such as subsidies for public transportation.

The average American has $53,850 in personal debt, which includes credit card debt, personal loans, and student loans, according to a Credit Karma poll. According to the same poll, 24% of Americans have debt from personal loans, 21% from school loans, and 33% from credit card debt. For financial stability and to lessen the stress that comes with uncertain finances, debt management is essential. People can take charge of their finances and strive towards becoming debt-free by using these suggestions and creating a debt management strategy.

How to improve Credit Scores

The average credit score in the US is 710, whereas the average credit score in the UK is 380, according to Experian. The following advice can help you raise your credit score in 2024:

- Remit payments on time: Your credit score is primarily determined by your payment history. Paying your bills on time will help you avoid having a bad credit score.

- Decrease credit usage: Pay off debt and refrain from using all of your credit cards to the limit to keep your credit utilisation low. It is recommended by experts to always maintain your credit utilisation below 30% of your credit limit.

- Verfiy your credit record: Check your credit report frequently for mistakes, and file a dispute if you find any. Every year, you are eligible to receive a free credit report from each of the three main credit bureaus.

- Acquire authorization: Ask a dependable friend or family member who has good credit to add you as an authorised user to their account. Your credit score may rise as a result of this.

- Employ a variety of credit kinds: A variety of credit kinds, including credit cards, mortgages, and other loans, can help raise your credit score. But only take on as much as you can manage responsibly.

- Steer clear of pointless credit inquiries: Each time you apply for credit, your score could momentarily decline. Refrain from making needless credit inquiries and only apply for credit when required.

- Use Experian Boost:To add qualifying rent payments to your credit report at no cost, register for Experian Boost. By doing this, your credit score may rise.

- Speak with creditors: If you’re having trouble making your payments, get in touch with them to talk about debt settlement or other payment choices.

- Maintain open previous accounts: Even if your oldest accounts are closed, keep them active because they show a better credit history.

- Have patience: Raising your credit score is a process that happens gradually over time. When trying to raise your score, be persistent and patient.

Key takeaways

- Achieving your own financial goals, such as saving for your child’s college education or retirement or having enough money for immediate necessities, is what personal finance is all about.

- Income, spending, savings, investments, and protection are the main facts of personal finance planning management.

- Budgeting, setting up an emergency fund, paying off debt, judicious use of credit cards, retirement savings, and many more measures are all part of smart personal finances.

- Real wealth is determined by the money you have saved and invested, not by the things you own in material terms.

- It’s critical to acknowledge the influence of risk and luck on financial performance.

- One of the main concepts in personal finance is financial flexibility, which enables people to adjust to changing circumstances and make wiser financial decisions.

Frequently Asked Questions About Personal Finances

1. How can I prepare for 2024 financially?

To get ready financially for 2024, take stock of your current situation, make a budget, pay off high-interest debt, save money for emergencies, keep an eye on your credit score, make major expense plans, check your insurance policies, assess your investment portfolio, think about retiring early, and make use of technology. Extend your perspective and make a plan according to your individual objectives and time frames.

2. What are the investment strategy for 2024?

- Widen perspective, align with goals & timelines.

- Plan for retirement, minimize taxes.

- Tackle high-interest debt, anticipate costs.

- Hedge against inflation, adapt bond/stock ratios.

- Stay updated on tax law changes, remain flexible.

3. What are the five personal finance facts?

The five personal finance fact are Focus on Psychology, Budget breakdown, Efficient Investing, Debt Management & Portfolio Planning.

4. What are the examples of personal finance?

Budgeting, saving, investing, and retirement planning are just a few of the financial management tasks that go under the umbrella of personal finance for individuals and families. Paying, saving, investing, and purchasing protection, such insurance, are a few examples of personal finance. Comprehension of financial concepts and sound financial judgement are prerequisites for effective personal finance management. Long-term financial stability can only be attained by setting financial goals, making a budget, and managing debt. Free online courses, blogs, podcasts, books, and podcasts can all teach you about personal finance.

5. What are the 10 personal finance rule?

- Spend Less Than You Earn

- Create a Budget

- Pay Yourself First (Save 10–15%)

- Have a Financial Plan

- Avoid Debt (Pay Off Existing Debt Quickly)

- Build an Emergency Fund (Three to Six Months’ Worth of Living Expenses)

- Maximize Retirement Contributions

- Diversify Your Investments

- Protect Your Assets (Insurance Coverage, Estate Plan)

- Continuously Educate Yourself About Personal Finance

The outcome for personal finance in 2024 is uncertain. With probable changes to tax legislation, inflation, and market volatility, the future of personal finance in 2024 is unclear. 2024 is predicted to bring about changes in state pensions, childcare costs, national insurance, taxes, and benefits.

In an imperfect world, investors will need to locate opportunities and steer clear of potential dangers by making thoughtful decisions and closely monitoring policy. A budget, paying off high-interest debt, diversifying your income sources, recognizing your present financial status, and setting realistic financial goals are some personal financial planning tips. A personal finance calendar, which keeps track of significant dates like tax deadlines and market-moving events, can be helpful with investing, saving, and budgeting.

9 thoughts on “Personal Finance Definition & What makes it significant”