The Importance of Financial Literacy and the Role of Books

Financial literacy is a crucial skill that everyone should possess in order to make informed decisions about their personal finances. It involves having the knowledge and understanding of various financial concepts, such as budgeting, saving, investing, and managing debt. With the increasing complexity of the financial landscape, it has become more important than ever for individuals to be equipped with the necessary skills to navigate their financial lives successfully.

Best personal finance books on financial literacy play a significant role in providing education and guidance on personal finance matters. They serve as valuable resources that offer practical advice, strategies, and insights into managing money effectively. These books cover a wide range of topics, including budgeting techniques, investment strategies, retirement planning, and debt management.

The importance of financial literacy cannot be overstated. It empowers individuals to take control of their finances and make informed decisions that can lead to long-term financial stability and security. Without a solid understanding of personal finance principles, individuals may fall prey to predatory lending practices or make uninformed investment choices that can have detrimental effects on their financial well-being.

Books on financial literacy serve as powerful tools for promoting awareness and education about personal finance matters. They provide accessible information that can be easily understood by individuals at all levels of financial knowledge. Whether you are just starting your journey towards financial independence or looking to enhance your existing knowledge, these books offer valuable insights into building wealth and achieving your financial goals.

In this section, we will explore the importance of financial literacy in more detail and delve into how books on financial literacy play a vital role in equipping individuals with the knowledge they need to make sound financial decisions. We will also highlight some recommended books that cover various aspects of personal finance education for readers at different stages of their journey towards greater financial literacy.

Table of Contents

Top 10 Best Personal Finance Books

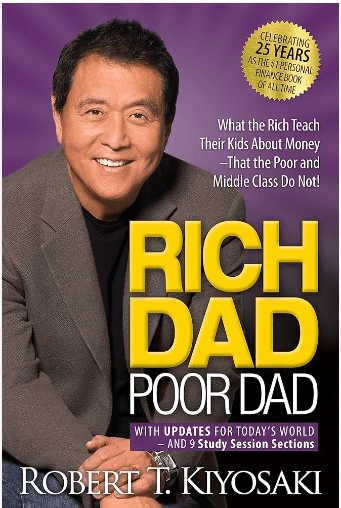

“Rich Dad Poor Dad” by Robert Kiyosaki

“Rich Dad Poor Dad” by Robert Kiyosaki is widely regarded as one of the best personal finance books available. In this book, Kiyosaki shares his unique perspective on financial mindset and wealth creation.

One of the key concepts explored in “Rich Dad Poor Dad” is the difference between assets and liabilities. Kiyosaki emphasizes the importance of acquiring assets that generate income, rather than accumulating liabilities that drain financial resources. He challenges traditional notions of wealth and encourages readers to develop a mindset focused on building a portfolio of income-generating assets.

Through personal anecdotes and practical advice, Kiyosaki provides readers with insights into how they can change their financial trajectory. He offers guidance on topics such as investing, entrepreneurship, and developing a passive income stream.

“Rich Dad Poor Dad” has resonated with millions of readers worldwide due to its straightforward approach to personal finance. It serves as an inspiration for individuals seeking to improve their financial literacy and take control of their economic future. Whether you are just starting your journey towards financial independence or looking to refine your existing strategies, this book offers valuable insights that can help you navigate the path to wealth creation.

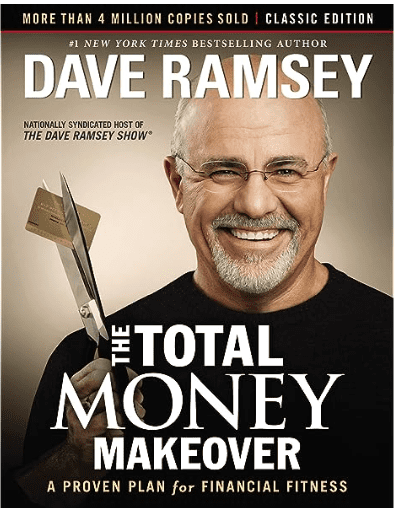

“The Total Money Makeover” by Dave Ramsey

“The Total Money Makeover” by Dave Ramsey is a widely acclaimed book that offers practical advice on debt management, budgeting techniques, emergency funds, and saving strategies. Ramsey’s approach to personal finance revolves around the concept of taking control of your money and making intentional decisions to achieve financial freedom.

One of the key principles emphasized in this book is the importance of getting out of debt. Ramsey provides step-by-step guidance on how to create a debt snowball plan, where you tackle your smallest debts first and then build momentum as you pay off larger debts. By following this strategy, individuals can gain a sense of accomplishment and motivation as they see their debts gradually decrease.

Budgeting techniques are another crucial aspect covered in “The Total Money Makeover.” Ramsey encourages readers to create a detailed budget that accounts for every dollar earned and spent. This helps individuals prioritize their expenses, cut unnecessary costs, and allocate funds towards savings or debt repayment.

In addition to managing debt and budgeting effectively, Ramsey emphasizes the significance of building an emergency fund. He advises readers to set aside three to six months’ worth of living expenses in a separate savings account. This serves as a safety net during unexpected financial challenges such as job loss or medical emergencies.

Furthermore, “The Total Money Makeover” provides various saving strategies that can help individuals achieve their financial goals faster. Ramsey suggests adopting frugal habits like cutting back on unnecessary expenses, negotiating better deals on bills, and finding ways to increase income through side hustles or entrepreneurship.

Overall, “The Total Money Makeover” offers practical advice and actionable steps for individuals seeking to improve their financial situation. It serves as a comprehensive guide for anyone looking to take control of their finances, manage debt effectively, create budgets that work for them, establish emergency funds, and adopt saving strategies that lead to long-term financial stability.

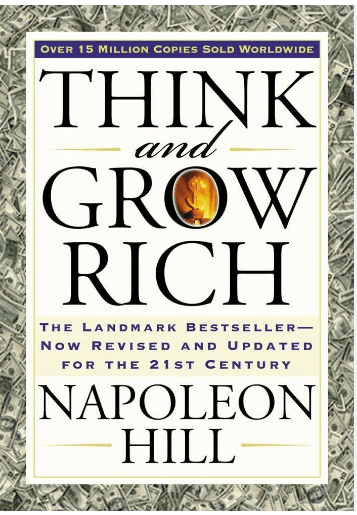

“Think and Grow Rich” by Napoleon Hill

“Think and Grow Rich” by Napoleon Hill is a timeless classic that explores the principles of success mindset and wealth accumulation strategies. One of the key concepts emphasized in this book is the power of positive thinking.

Hill’s book delves into the idea that our thoughts and beliefs shape our reality. By cultivating a positive mindset, individuals can attract success and abundance into their lives. This involves developing a strong belief in oneself, visualizing goals, and maintaining unwavering determination.

Moreover, “Think and Grow Rich” provides practical strategies for accumulating wealth. Hill emphasizes the importance of setting clear goals, creating detailed plans, and taking persistent action towards achieving them. He also highlights the significance of surrounding oneself with like-minded individuals who support and encourage personal growth.

Throughout the book, Hill shares inspiring stories of successful individuals who have applied these principles to achieve extraordinary results. He offers valuable insights into how anyone can tap into their full potential to create a life of abundance and fulfillment.

In summary, “Think and Grow Rich” serves as a guidebook for cultivating a success mindset, harnessing the power of positive thinking, and implementing effective wealth accumulation strategies. It is an invaluable resource for those seeking personal growth, financial success, and overall fulfillment in life.

“The Intelligent Investor” by Benjamin Graham

“The Intelligent Investor” by Benjamin Graham is a timeless classic that has greatly influenced the field of investment and finance. Published in 1949, this book offers valuable insights into investment principles and strategies that are still relevant today.

One of the key concepts introduced in “The Intelligent Investor” is the value investing strategy. Graham emphasizes the importance of analyzing stocks based on their intrinsic value rather than market fluctuations. He encourages investors to focus on companies with solid fundamentals, such as strong financials, competitive advantages, and sustainable business models.

Graham also highlights the significance of conducting thorough stock market analysis. He advocates for a disciplined approach to investing, emphasizing the need for careful research and analysis before making any investment decisions. By examining financial statements, assessing industry trends, and evaluating management competence, investors can make informed choices that align with their long-term goals.

“The Intelligent Investor” provides practical advice on how to navigate through various market conditions while minimizing risks. It emphasizes the importance of patience, diversification, and avoiding speculative behavior. Graham’s principles promote a conservative yet rational approach to investing that focuses on long-term wealth creation rather than short-term gains.

Overall, “The Intelligent Investor” serves as an essential guide for both novice and experienced investors alike. Its timeless wisdom continues to resonate with those seeking sound investment strategies based on fundamental analysis and a disciplined mindset.

“A Random Walk Down Wall Street” by Burton Malkiel

“A Random Walk Down Wall Street” by Burton Malkiel is a renowned book that explores the principles of investing and provides valuable insights into the world of finance. One of the key concepts discussed in this book is the efficient market hypothesis, which suggests that financial markets are highly efficient and it is difficult to consistently outperform them.

Malkiel emphasizes the importance of index fund investing as a strategy for long-term success. He argues that actively managed funds often fail to beat the market consistently, and therefore, investors should consider low-cost index funds that aim to replicate the performance of a specific market index.

Furthermore, “A Random Walk Down Wall Street” highlights the significance of portfolio diversification. Malkiel stresses that spreading investments across different asset classes can help reduce risk and increase potential returns. By diversifying one’s portfolio, investors can offset losses in certain investments with gains in others, ultimately achieving a more stable and balanced investment approach.

Overall, this book serves as a valuable resource for both novice and experienced investors seeking to understand key concepts such as efficient market hypothesis, index fund investing, and portfolio diversification.

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko is a renowned book that explores the habits and traits of millionaires, shedding light on their secrets to building wealth over time. The authors conducted extensive research to uncover the common characteristics shared by individuals who have successfully accumulated significant wealth.

One of the key takeaways from the book is the emphasis on frugal living. Contrary to popular belief, many millionaires are not extravagant spenders but rather practice a disciplined approach to managing their finances. They prioritize saving and investing over excessive consumption, which allows them to accumulate wealth steadily.

The book also highlights the importance of long-term thinking and delayed gratification. Millionaires often have a clear vision of their financial goals and are willing to make sacrifices in the short term in order to achieve them. They understand that building wealth takes time and requires consistent effort.

By examining real-life examples and case studies, “The Millionaire Next Door” provides practical insights into how anyone can adopt these millionaire habits and traits in their own lives. It serves as a guide for individuals who aspire to achieve financial independence and build lasting wealth through prudent financial choices and frugal living practices.

“I Will Teach You to Be Rich” by Ramit Sethi

“I Will Teach You to Be Rich” by Ramit Sethi is a comprehensive manual on personal finance that aims to empower readers with practical strategies for managing their money effectively. One of the key principles emphasized in this book is the importance of automating finances.

Sethi advocates for setting up systems and processes that automatically allocate funds towards savings, investments, and bill payments. By doing so, individuals can ensure that they are consistently building wealth without having to actively manage their finances on a daily basis.

In addition to automating finances, “I Will Teach You to Be Rich” also delves into the topic of optimizing credit card rewards. Sethi provides valuable insights on how to strategically choose credit cards based on their rewards programs and maximize the benefits they offer. This includes tips on selecting cards with cashback or travel rewards that align with one’s spending habits and financial goals.

By following Sethi’s advice in his book, readers can gain a better understanding of personal finance management, learn how to automate their financial processes, and optimize credit card rewards for maximum benefit.

“Your Money or Your Life” by Vicki Robin and Joe Dominguez

“Your Money or Your Life” by Vicki Robin and Joe Dominguez is a highly influential book that explores the concept of financial independence and finding fulfillment through aligning our money with our values.

The book provides practical strategies and thought-provoking insights to help readers achieve their financial goals while also living a more fulfilling life. It challenges the traditional notion of equating money with happiness and encourages readers to reassess their relationship with money.

Through a nine-step program, “Your Money or Your Life” guides readers on how to track their spending, calculate the true value of their time, and make conscious choices that align with their values. By doing so, the authors argue that individuals can gain control over their finances, reduce unnecessary expenses, and ultimately achieve financial independence.

Moreover, the book goes beyond just managing money; it delves into deeper aspects of personal fulfillment. It prompts readers to question societal norms around consumerism and materialism, encouraging them to prioritize experiences over possessions.

Whether you are struggling with debt, seeking early retirement, or simply looking for ways to live a more intentional life, “Your Money or Your Life” offers valuable insights and practical advice. By reevaluating our relationship with money and aligning it with our values, we can not only achieve financial goals but also find true fulfillment in our lives.

“The Little Book of Common Sense Investing” by John C. Bogle

“The Little Book of Common Sense Investing” by John C. Bogle is a highly regarded book that delves into the world of passive investing strategies, emphasizing the use of low-cost index funds for long-term wealth building.

In this book, Bogle, the founder of Vanguard Group and a pioneer in the field of index investing, shares his insights and wisdom on how investors can achieve financial success through a common-sense approach to investing.

Bogle argues that actively managed funds often fail to outperform the market over the long term due to their higher fees and lack of consistent performance. Instead, he advocates for the use of low-cost index funds that aim to replicate the performance of a specific market index.

By following Bogle’s advice and adopting a passive investment strategy, investors can benefit from lower costs, broader diversification, and potentially higher returns over time. This approach aligns with Bogle’s belief that successful investing should be simple, low-cost, and focused on long-term goals rather than short-term market fluctuations.

“The Little Book of Common Sense Investing” serves as an informative guide for both novice and experienced investors who are seeking a practical roadmap to navigate today’s complex financial landscape while maximizing their chances for long-term wealth accumulation.

“The Richest Man in Babylon” by George S. Clason

“The Richest Man in Babylon” by George S. Clason is a timeless classic that offers valuable financial principles through engaging parables. This book serves as a guide to understanding and implementing key concepts related to saving, investing wisely, and building wealth.

Through a series of entertaining stories set in ancient Babylon, Clason provides practical advice on how individuals can take control of their finances and achieve financial success. The book emphasizes the importance of saving a portion of one’s income, living within means, and making wise investment choices.

One of the central lessons in “The Richest Man in Babylon” is the power of compound interest. Clason highlights how even small savings can grow significantly over time when invested wisely. By illustrating this principle through relatable characters and situations, readers are encouraged to develop disciplined saving habits and make informed investment decisions.

Furthermore, the book emphasizes the significance of acquiring financial knowledge and seeking guidance from experienced individuals. It stresses the importance of learning from those who have achieved financial success and using their wisdom to navigate personal finance decisions.

Overall, “The Richest Man in Babylon” offers valuable insights into building wealth by providing practical advice through captivating storytelling. Whether you are just starting your journey towards financial independence or looking for ways to enhance your existing financial strategies, this book serves as an excellent resource for understanding fundamental principles that can lead to long-term prosperity.

Expand Your Financial Knowledge with these Must-Read Finance Books

In conclusion, expanding your financial knowledge is crucial for personal and professional growth. Fortunately, there are numerous finance books available that can serve as valuable resources for improving your understanding of personal finance and investing.

When it comes to the best books about finance, there are several titles that consistently appear at the top of recommended reading lists. These books cover a wide range of topics, from basic personal finance principles to advanced investment strategies.

By dedicating time to read these finance books, you can gain insights into managing your money effectively, making informed investment decisions, and achieving financial independence. Additionally, these books can provide you with the necessary tools and knowledge to navigate complex financial situations with confidence.

Whether you are a beginner looking to enhance your financial literacy or an experienced investor seeking new perspectives, these top finance books offer valuable information and practical advice. Remember that investing in your own financial education is an investment that will pay off in the long run.

By taking advantage of these must-read finance books as well as other available resources on financial literacy, you can empower yourself to make sound financial decisions and build a secure future for yourself and your loved ones.

Also Read: Financial Literacy Unveiled: 10 Vital Principles for Empowerment