Understanding Cryptocurrency and the Role of Cryptocurrency Exchanges

Cryptocurrency has emerged as a revolutionary concept in the world of finance, offering an alternative to traditional forms of currency. It is a digital or virtual form of currency that utilizes cryptography for secure transactions and operates independently of any central authority. The underlying technology behind cryptocurrency is blockchain, a decentralized and transparent ledger that records all transactions.

One crucial aspect of the cryptocurrency ecosystem is cryptocurrency exchanges. These platforms enable users to buy, sell, and trade various cryptocurrencies using different fiat currencies or other cryptocurrencies. Cryptocurrency exchanges play a vital role in facilitating the exchange of digital assets and providing liquidity to the market.

As decentralized finance (DeFi) gains traction, cryptocurrency exchanges are becoming more than just trading platforms. They are evolving into comprehensive financial ecosystems that offer services such as lending, borrowing, staking, and yield farming. This expansion allows users to leverage their digital assets for financial opportunities beyond simple buying and selling.

Understanding the role of cryptocurrency exchanges is essential for anyone looking to venture into the world of cryptocurrencies or explore decentralized finance. By providing access to a wide range of digital currencies and supporting innovative financial instruments, these exchanges empower individuals to participate in this rapidly growing sector.

In this section, we will delve deeper into the intricacies of cryptocurrency exchanges, exploring their functions, benefits, challenges, and how they contribute to shaping the future landscape of digital currencies and decentralized finance.

Table of Contents

The Importance of Choosing the Right Cryptocurrency Exchange for Higher Returns

Choosing the right cryptocurrency exchange is crucial for maximizing returns on your crypto investments. With the growing popularity of cryptocurrencies, there are numerous crypto exchanges available, each offering different features and benefits.

A cryptocurrency exchange is a platform where you can buy, sell, and trade various cryptocurrencies. It serves as a marketplace for investors to connect with potential buyers or sellers of digital assets.

When selecting a cryptocurrency exchange, it’s essential to consider factors such as security measures, trading fees, available cryptocurrencies, liquidity, user interface, customer support, and regulatory compliance.

Security should be your top priority when choosing an exchange. Look for platforms that offer robust security measures such as two-factor authentication (2FA), cold storage for funds, encryption protocols, and regular security audits.

Trading fees can significantly impact your overall returns on investment. Compare the fee structures of different exchanges to find one that offers competitive rates without compromising on security or reliability.

The range of available cryptocurrencies also plays a vital role in selecting an exchange. Ensure that the platform supports the specific coins or tokens you wish to trade or invest in.

Liquidity refers to how easily you can buy or sell your cryptocurrencies without affecting their market prices significantly. Opting for exchanges with higher liquidity can provide better opportunities for executing trades at favorable prices.

User interface and ease of use are also important considerations. Look for exchanges with intuitive interfaces that make it easy to navigate through various trading tools and features.

Customer support is crucial in case you encounter any issues or have questions about using the platform effectively. Choose an exchange that offers responsive customer support channels such as live chat or email.

Lastly, regulatory compliance ensures that the exchange operates within legal frameworks and follows industry best practices. Opting for regulated exchanges provides an additional layer of protection for your investments.

By carefully considering these factors when choosing a cryptocurrency exchange, you can increase your chances of achieving higher returns on your crypto investment while ensuring a secure and reliable trading experience.

Top 5 Cryptocurrency Exchanges That Offer High Returns for Investors

- Binance: A Leading Global Cryptocurrency Exchange with High Return Potential

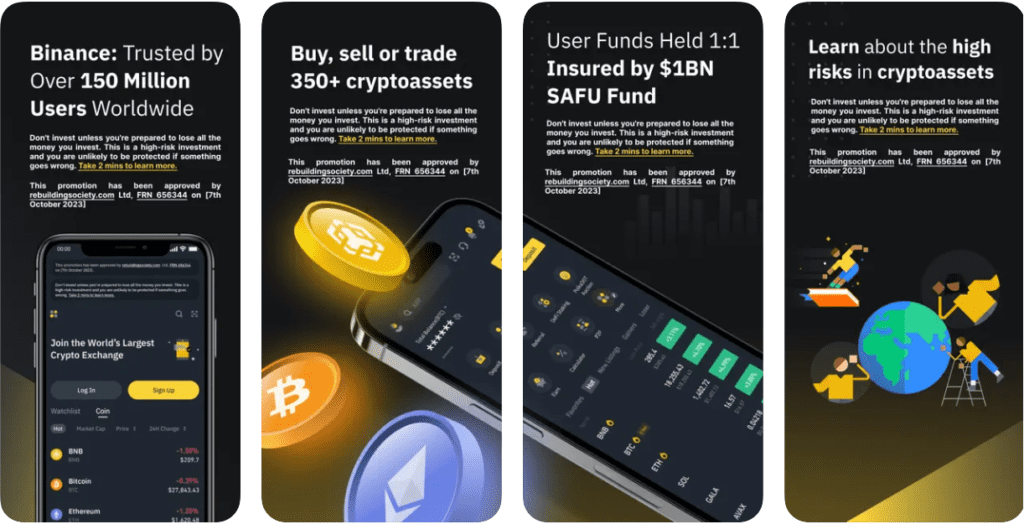

Binance is a globally recognized cryptocurrency exchange that has gained significant popularity in the digital asset industry. As one of the largest and most trusted exchanges, Binance offers a wide range of features and services to its users.

One of the standout aspects of Binance is its native cryptocurrency, Binance Coin (BNB). BNB has seen remarkable growth over the years and has become an attractive investment option for many traders and investors. With various use cases within the Binance ecosystem, including discounted trading fees and participation in token sales through Binance Launchpad, BNB holds high return potential.

In addition to traditional trading options, Binance also offers innovative opportunities such as yield farming. Yield farming allows users to earn passive income by providing liquidity to different DeFi protocols on the Binance Smart Chain network. This feature has attracted many individuals looking for alternative ways to generate returns on their cryptocurrency holdings.

Overall, with its robust platform, extensive range of services, and potential for high returns through features like yield farming, it is clear why Binance stands out as a leading global cryptocurrency exchange in today’s digital asset landscape.

- Coinbase: A Trusted Platform for Crypto Trading and Investment Opportunities

Coinbase exchange, Coinbase Pro, Coinbase Earn program, Coinbase custody services

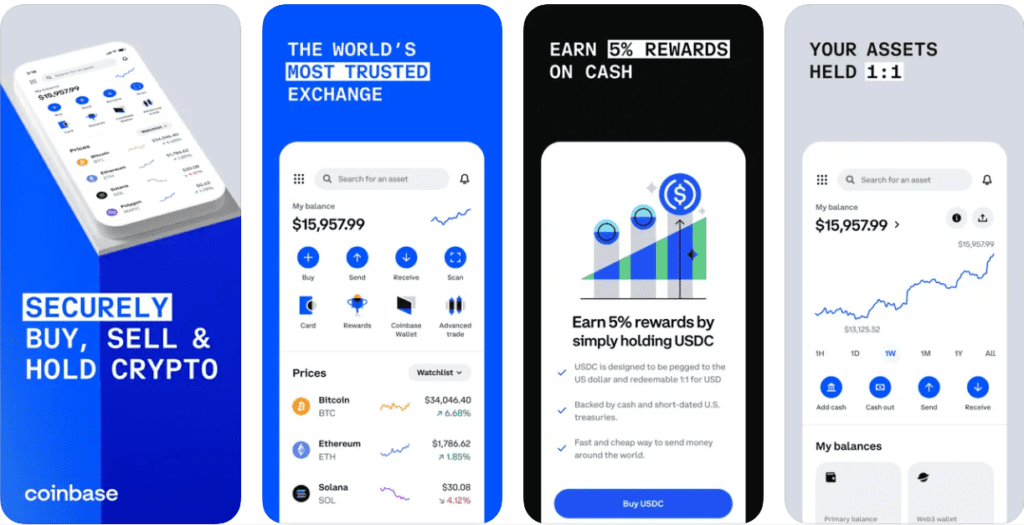

Coinbase has established itself as a trusted platform for individuals looking to engage in cryptocurrency trading and investment. As one of the largest and most well-known cryptocurrency exchanges, Coinbase offers a range of services designed to cater to both novice and experienced traders.

One of the key features of Coinbase is its user-friendly interface, making it easy for beginners to navigate and execute trades. Additionally, Coinbase offers a more advanced trading platform called Coinbase Pro, which provides additional tools and features for experienced traders looking for more control over their trades.

In addition to trading services, Coinbase also offers an educational program known as Coinbase Earn. This program allows users to earn various cryptocurrencies by completing educational tasks related to those specific digital assets. This not only provides users with valuable knowledge about different cryptocurrencies but also gives them an opportunity to acquire these assets without having to make a financial investment.

Furthermore, Coinbase provides custody services for institutional investors or individuals who want an extra layer of security for their digital assets. With its robust security measures and insurance coverage, Coinbase aims to provide peace of mind when it comes to storing cryptocurrencies.

Overall, Coinbase has positioned itself as a reliable and trustworthy platform in the world of cryptocurrency trading and investment. Its user-friendly interface, educational programs like Coinbase Earn, advanced trading options through Coinbase Pro, and secure custody services make it an attractive choice for both beginners and seasoned investors alike.

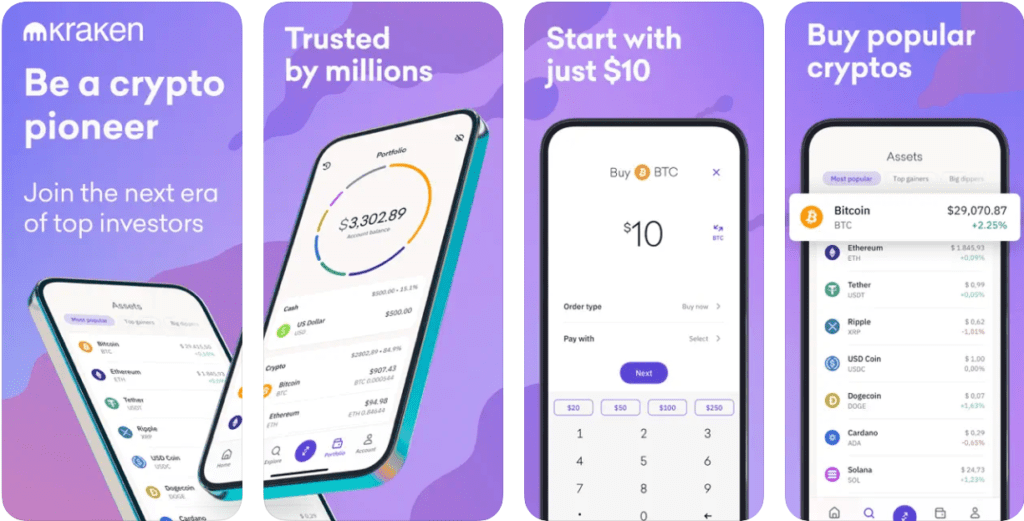

- Kraken: An Established Crypto Exchange with a Wide Range of Investment Options

Kraken, a well-established cryptocurrency exchange, offers a comprehensive range of investment options for crypto enthusiasts. With its user-friendly interface and advanced features, Kraken has become a go-to platform for both beginners and experienced traders.

One of the key offerings from Kraken is the Kraken Pro platform. This professional-grade trading platform provides users with advanced charting tools, real-time market data, and customizable trading interfaces. It caters to the needs of active traders who require more sophisticated trading features.

In addition to trading, Kraken also offers a staking rewards program. Staking allows users to earn passive income by holding certain cryptocurrencies in their wallets. By participating in the staking program on Kraken, users can earn rewards simply by holding their coins on the exchange.

Kraken also provides access to futures trading. With Kraken Futures, users can trade cryptocurrency contracts with leverage, allowing them to amplify their potential profits or losses. This feature is particularly appealing to traders looking for more advanced trading strategies and opportunities.

Overall, Kraken stands out as a reliable and reputable crypto exchange that caters to the diverse needs of investors. Whether you are looking for a user-friendly interface or advanced trading options like staking rewards or futures trading, Kraken has you covered.

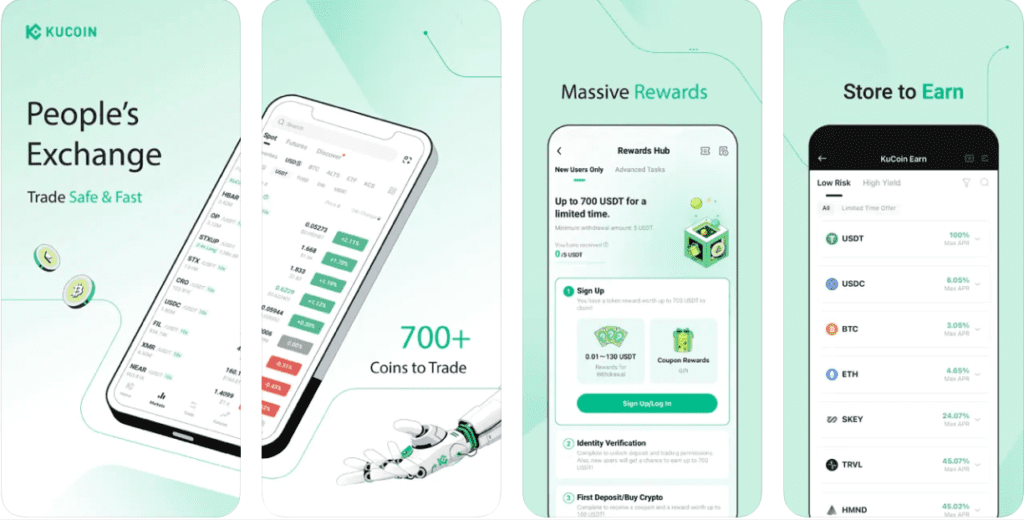

- KuCoin: A Growing Exchange with Innovative Features and Profitable Investment Opportunities

KuCoin is a rapidly growing cryptocurrency exchange that has gained popularity for its innovative features and profitable investment opportunities. One of the unique aspects of KuCoin is its native token called KuCoin Shares (KCS), which offers various benefits to its holders.

KCS holders can receive daily dividends from the exchange’s trading fees, providing them with a passive income stream. Additionally, KCS holders can enjoy reduced trading fees, priority customer support, and participation in exclusive token sales on the KuCoin Spotlight platform.

Speaking of the KuCoin Spotlight platform, it is worth mentioning that it has gained significant attention in the crypto community. This platform allows users to participate in curated token sales of promising projects before they are listed on major exchanges. This provides investors with early access to potentially lucrative investment opportunities.

Overall, KuCoin stands out among other exchanges due to its innovative features such as KCS and the Spotlight platform. These offerings provide users with additional incentives and opportunities for profit within the cryptocurrency market.

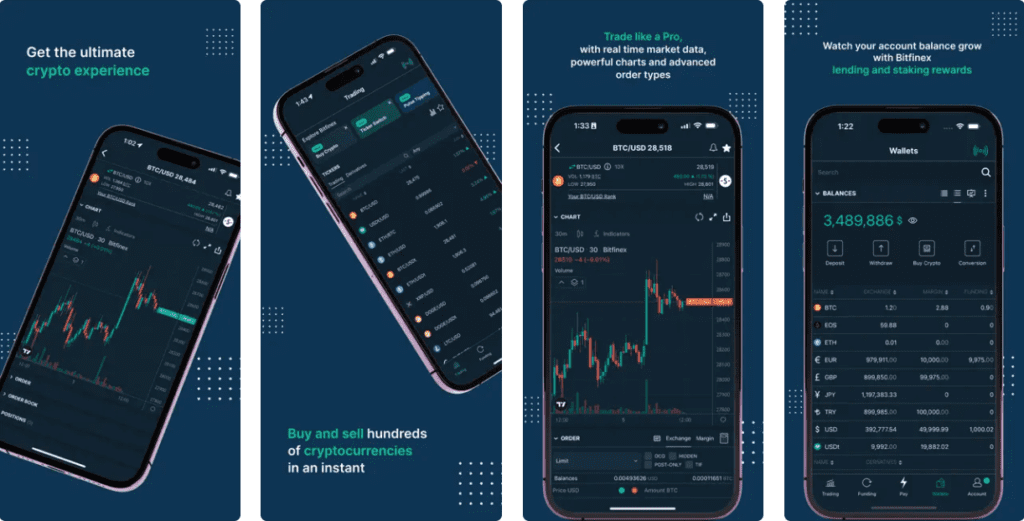

- Bitfinex: A Feature-Rich Crypto Trading Platform Offering Potential High Returns

Bitfinex is a well-established cryptocurrency trading platform that offers a wide range of features for traders looking to engage in the crypto market. One of the standout features of Bitfinex is its comprehensive set of tools and options for margin trading.

Margin trading allows traders to amplify their trading positions by borrowing funds from the exchange. Bitfinex provides users with the ability to trade on margin with leverage, enabling them to potentially increase their returns on successful trades. This feature can be particularly appealing for experienced traders who are comfortable with taking on higher levels of risk in pursuit of greater profits.

In addition to margin trading, Bitfinex offers a host of other features that make it a popular choice among cryptocurrency enthusiasts. The platform provides access to a wide range of cryptocurrencies, including major coins like Bitcoin and Ethereum, as well as lesser-known altcoins. Traders can also take advantage of advanced order types and customizable trading interfaces, allowing them to tailor their trading experience to their specific needs.

Furthermore, Bitfinex boasts robust security measures and has implemented various safeguards to protect user funds. These include cold storage for most digital assets and two-factor authentication (2FA) options for enhanced account security.

Overall, Bitfinex stands out as a feature-rich crypto trading platform that caters to both novice and experienced traders alike. Its margin trading options provide an opportunity for potentially higher returns, while its comprehensive set of features ensures a seamless and secure trading experience.

Choose Wisely to Maximize Returns in the World of Cryptocurrencies

In conclusion, the world of cryptocurrencies offers immense potential for investment and returns. However, it is crucial to approach this space with caution and make wise choices to maximize your returns.

When it comes to investing in cryptocurrencies, thorough research and risk management are key. It is important to understand the fundamentals of different cryptocurrencies, their underlying technology, market trends, and potential risks involved. This knowledge will enable you to make informed decisions and choose wisely among the vast array of options available.

Furthermore, diversification is essential in cryptocurrency investments. Spreading your investments across different cryptocurrencies can help mitigate risks and increase the likelihood of achieving favorable returns.

Additionally, staying updated with the latest news and developments in the cryptocurrency market is vital. The crypto market is highly dynamic and can be influenced by various factors such as regulatory changes or technological advancements. Being aware of these factors will allow you to adapt your investment strategy accordingly.

Lastly, it is advisable to seek professional advice from financial experts or cryptocurrency specialists who can provide guidance based on their expertise and experience in this field.

By choosing wisely and adopting a strategic approach that includes thorough research, risk management techniques, diversification, staying informed about market trends, and seeking expert advice when needed; you can maximize your returns in the world of cryptocurrencies while minimizing potential risks.

Also Read: How to Start Investing: A Comprehensive Guide for Beginners to Build Wealth In 2024