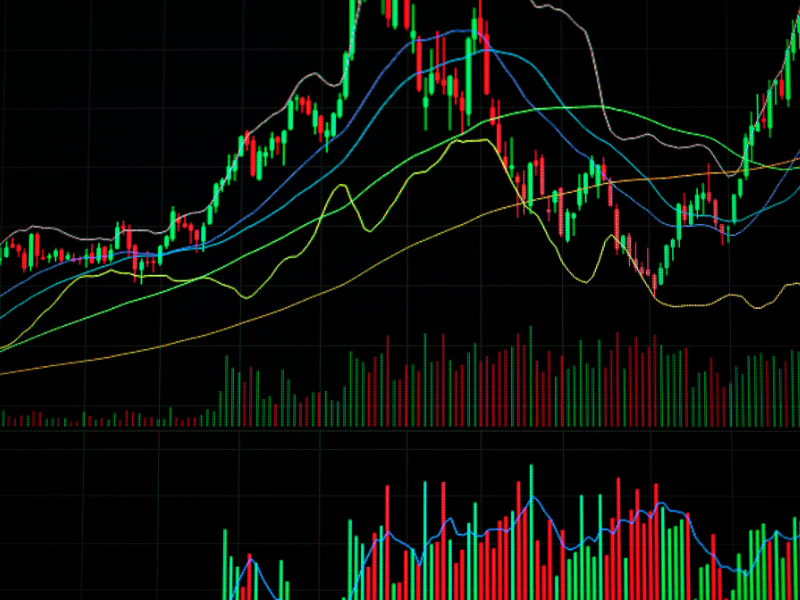

let’s delve into the dynamic world of stock markets and the key happenings investors should be aware of before the opening bell on Monday.

1. Wall Street’s Winning Streak

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite are riding high on a five-week winning streak, culminating in a stellar November. Wall Street is cautiously optimistic, hoping stocks can sustain their climb through the upcoming week. The S&P 500 marked its highest level since March 2022 last Friday. The continuation of this positive trend hinges significantly on the November jobs data scheduled for release later in the week. The data will play a crucial role in shaping the Federal Reserve’s stance on interest rates, influencing market sentiments for the foreseeable future.

2. Alaska Air’s Ambitious Move

In a major development in the airline industry, Alaska Air has inked a deal to acquire Hawaiian Airlines for a substantial $1.9 billion. Alaska CEO Ben Minicucci expressed strategic intent, aiming to strengthen Alaska’s position against the dominant quartet of carriers in the U.S. market. Hawaiian Airlines, facing challenges like the Maui wildfires and reduced travel to and from Asia, is seen as a valuable addition. However, the consolidation comes with its set of risks. The Biden administration’s Justice Department has previously intervened to block airline partnerships, raising potential hurdles for this acquisition.

3. Spotify’s Unplugged Workforce

The harmonious tunes at Spotify are being disrupted as the music streaming giant announces a significant workforce reduction. Spotify is set to lay off 17% of its employees, translating to approximately 1,500 staff members. CEO Daniel Ek attributes this move to a necessary adjustment in costs after a phase of expansion facilitated by accessible capital. This restructuring follows earlier layoffs at Spotify, and the company is redirecting its focus towards building its podcast and audiobooks businesses.

4. Gold’s Shining Moment

The allure of gold reached new heights as prices touched a record high on Monday, surpassing $2,100 per ounce. Geopolitical tensions, notably the conflict between Israel and Hamas, have contributed to the surge in gold prices. Looking ahead to the coming year, the prospect of potential Federal Reserve interest rate cuts and a resultant lower U.S. dollar could further elevate the precious metal’s value. Gold continues to be a haven for investors during uncertain times.

5. Retailers’ Thanksgiving Triumph

Retailers reveled in a robust Thanksgiving shopping weekend, surpassing industry expectations. The five-day shopping spree witnessed an impressive 8% growth in online spending, accompanied by record-breaking foot traffic. However, the strength displayed during this period may not necessarily translate into a blockbuster December. Observers speculate that cost-conscious shoppers, eager for early deals and discounts, may have expedited their purchases online. Additionally, a sudden onset of cold weather might have prompted consumers to invest in winter clothing that they refrained from buying during a warmer fall.

As investors gear up for Monday’s stock market opening, the landscape appears both promising and nuanced. The unfolding scenarios in aviation, music streaming, precious metals, and retail reflect the intricate dance of economic forces and consumer behaviors. Navigating these fluctuations requires a keen eye, strategic acumen, and a readiness to adapt to the ever-evolving market dynamics. Stay tuned for a week that promises excitement, challenges, and the potential for lucrative opportunities in the financial realm.

Also Read the Article: Beginner’s Guide to Stock Market Investments: Tips and Strategies