Budgeting. The word itself can evoke feelings of dread and confusion for many people. It may seem overwhelming, complex, or just downright boring. But fear not! Budgeting doesn’t have to be a daunting task. In fact, it can be an empowering tool that puts you in control of your financial future. So, if you’re ready to take charge of your finances and start building a solid foundation for success, this comprehensive guide is for you!

Table of Contents

The Power of Budgeting

Before we dive into the nitty-gritty details, let’s take a moment to understand why budgeting is so important. Simply put, budgeting is the process of creating a plan for how you will spend and save your money. It allows you to track your income, expenses, and savings goals, helping you make informed decisions about your finances. Budgeting is like a roadmap that guides your financial journey, ensuring that you’re heading in the right direction.

Creating Financial Security

One of the key benefits of budgeting is the ability to create financial security. By carefully planning your expenses and saving for emergencies, you can build a safety net that protects you from unexpected financial setbacks. Whether it’s a sudden medical expense, a major car repair, or even a job loss, having a well-structured budget can help you weather the storm with confidence.

Achieving Financial Goals

Budgeting also empowers you to achieve your long-term financial goals. Whether you dream of buying a house, starting a business, or traveling the world, budgeting can help turn those dreams into reality. By allocating your income towards specific savings categories, you can steadily build up the funds needed to achieve your goals. Budgeting helps you prioritize your spending and stay on track, ensuring that your hard-earned money is working towards your aspirations.

Reducing Stress and Anxiety

Let’s face it, money is a major source of stress for many people. But with a well-planned budget, you can alleviate some of that financial anxiety. When you know exactly where your money is going and have a clear picture of your financial situation, you can make informed decisions with confidence. Budgeting brings peace of mind, as you’ll no longer be in the dark about your finances, but rather in control of them.

Getting Started with Budgeting

Now that we understand why budgeting is crucial, let’s dive into the practical steps of getting started. Don’t worry if you’re new to budgeting – we’ll guide you through each stage, from assessing your current financial situation to creating a budget that suits your unique needs and goals.

Step 1: Assess Your Financial Situation

Before you can create a budget, it’s important to understand your current financial situation. Take stock of your income, expenses, debts, and savings. Calculate your total monthly income and compare it to your fixed expenses (such as rent or mortgage payments, utility bills, and loan repayments). Then, analyze your discretionary spending (such as entertainment, dining out, and shopping). This assessment will give you a clear picture of where your money is going and help you identify areas for improvement.

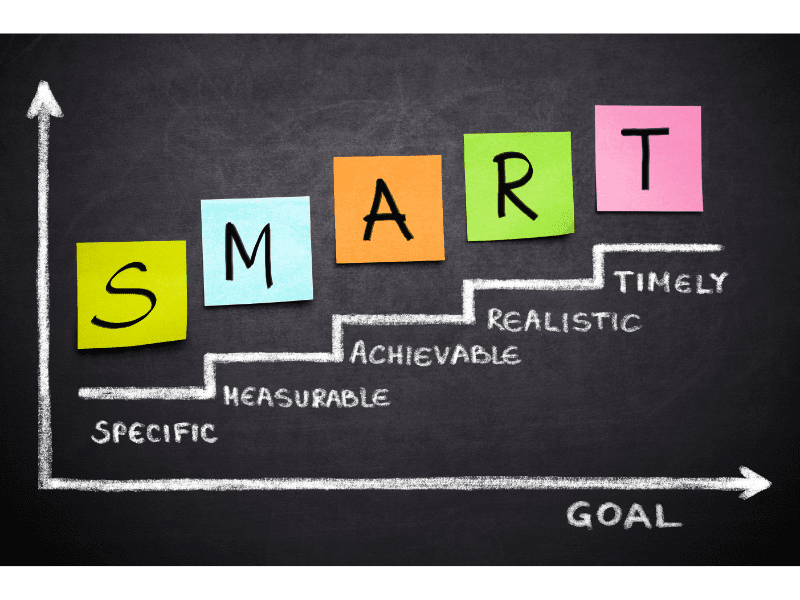

Step 2: Set SMART Goals

Once you have a clear understanding of your finances, it’s time to set goals. SMART goals are specific, measurable, attainable, relevant, and time-bound. For example, instead of saying “I want to save money,” a SMART goal would be “I want to save $500 per month for a down payment on a house by the end of the year.” Setting achievable goals gives you a clear target to work towards and keeps you motivated along the way.

Step 3: Track Your Income and Expenses

To create an accurate budget, you need to track your income and expenses. This can be done using a simple spreadsheet or budgeting app. Record your income sources and the amount received each month. Then, track your expenses by category (such as housing, transportation, groceries, and entertainment). Be diligent in recording every transaction, no matter how small. This step will give you a clear understanding of your spending patterns and help you spot areas where you can cut back.

Step 4: Create Your Budget

Armed with the knowledge of your financial situation and spending patterns, it’s time to create your budget. Start by allocating your income towards your fixed expenses, such as rent or mortgage payments, utility bills, and loan repayments. Next, assign a portion of your income towards your savings goals. Finally, budget for discretionary spending, but be mindful of your goals and prioritize your spending accordingly. Remember, a budget is a flexible tool that can be adjusted as needed, so don’t be afraid to make changes along the way.

Step 5: Stick to Your Budget

Creating a budget is only half the battle – sticking to it is where the real challenge lies. To ensure the success of your budget, track your actual expenses regularly and compare them to your budgeted amounts. Make adjustments as needed to stay on track. It’s important to be disciplined and avoid overspending, but also remember to allow yourself some flexibility for occasional splurges or unforeseen expenses. Consistency is key, so make budgeting a habit and you’ll reap the rewards in the long run.

Tools and Strategies for Successful Budgeting

Now that you have the basic framework of budgeting in place, let’s explore some tools and strategies that can enhance your budgeting journey.

Envelope System

The envelope system is a simple and effective way to control discretionary spending. Assign a specific amount of cash to various categories (such as groceries, entertainment, and dining out) and place that cash in separate envelopes. As you spend from each category, take the money from the corresponding envelope. This physical representation of your budget helps you visualize your spending and prevents overspending.

Automated Savings

Automating your savings is a powerful strategy that removes the temptation to spend your allocated savings. Set up automatic transfers from your checking account to a separate savings account or investment account. This way, you’ll save a predetermined amount each month without even thinking about it. Over time, your savings will grow significantly, helping you achieve your financial goals faster.

Emergency Fund

Building an emergency fund should be a top priority in your budgeting journey. Aim to save three to six months’ worth of living expenses in an easily accessible account. This fund will provide a safety net in case of unexpected events, such as job loss or medical emergencies. Having an emergency fund reduces financial stress and gives you peace of mind.

Debt Repayment Plan

If you have existing debts, such as credit card debt or student loans, it’s essential to include a debt repayment plan in your budget. Allocate a portion of your income towards debt repayment, focusing on high-interest debts first. By systematically paying off your debts, you’ll not only reduce your financial burden but also free up additional funds for savings and investments in the future.

Review and Adjust Regularly

Budgeting is an ongoing process, not a one-time activity. It’s important to review your budget regularly and make adjustments as needed. Life circumstances change, expenses fluctuate, and new goals arise. By regularly reviewing and adjusting your budget, you’ll ensure that it remains relevant and effective.

Take Control of Your Finances and Thrive

Congratulations! You’ve made it through the comprehensive guide to budgeting for beginners. You now have the knowledge and tools to take control of your finances and build a solid foundation for a thriving financial future. Remember, budgeting is a journey, and it may take time to fully embrace this new way of managing your money. Be patient, stay committed to your goals, and celebrate your progress along the way. With every dollar you save and every financial goal you achieve, you’ll be one step closer to financial freedom. So go forth, harness the power of budgeting, and embrace a brighter financial future in 2024 and beyond!

Also Read: Budgeting Tips for Beginners: A Comprehensive Guide in 2023

1 thought on “Budgeting for Beginners: Taking Control of Your Finances in 2024”