What is a Financial Plan Definition and Why is it Crucial for Your Financial Success?

In today’s fast-paced and ever-changing world, financial stability and success have become more important than ever. But achieving financial goals can be challenging without a well-thought-out roadmap. This is where a financial plan comes into play.

A financial plan is a comprehensive strategy that helps individuals, families, and businesses effectively manage their finances to achieve specific financial goals. It serves as a blueprint for managing income, expenses, investments, savings, and debt in order to build wealth and ensure long-term financial security.

But why is having a financial plan crucial for your financial success? The answer lies in the fact that without proper planning, it becomes difficult to make informed decisions about money matters. A well-crafted financial plan provides clarity on how to allocate resources wisely, reduce unnecessary expenses, maximize savings potential, and make strategic investments.

Moreover, a financial plan helps individuals navigate through various life stages such as buying a home, starting a family or business venture, planning for retirement or education expenses. It acts as a guide that enables you to anticipate potential risks and challenges while taking advantage of opportunities that come your way.

By having a clear understanding of your current financial situation and setting realistic goals for the future, you can make informed decisions about budgeting, saving strategies, investment options, insurance coverage needs and debt management. A comprehensive financial plan takes into account your income sources, assets and liabilities along with your short-term priorities and long-term aspirations.

Ultimately, the goal of creating a solid financial plan is not only about accumulating wealth but also about gaining peace of mind knowing that you are prepared for whatever life throws at you financially. It empowers you to take control of your finances rather than being controlled by them.

In the following sections of this guide on Financial Planning Basics: What is it All About?, we will delve deeper into the key components of an effective financial plan along with practical tips on how to create one tailored to your unique circumstances. So, let’s get started on the path towards financial success!

Table of Contents

The Key Components of a Comprehensive Financial Plan

A comprehensive financial plan is essential for individuals and businesses alike to achieve their financial goals and secure their future. To create a successful financial plan, several key components must be considered and integrated seamlessly.

One of the primary elements of a financial plan is setting clear and realistic goals. These goals serve as the foundation for the entire planning process. Whether it’s saving for retirement, buying a home, or starting a business, having specific objectives helps guide decision-making and prioritize actions.

Another crucial aspect of financial planning is assessing one’s current financial situation. This includes evaluating income, expenses, assets, liabilities, and cash flow patterns. Understanding where one stands financially provides valuable insights into areas that need improvement or adjustment.

Risk management is another vital component of a comprehensive financial plan. This involves identifying potential risks such as loss of income due to disability or death and implementing strategies to mitigate these risks through insurance coverage or contingency plans.

Investment planning also plays a significant role in achieving long-term financial success. It involves creating an investment strategy that aligns with an individual’s risk tolerance, time horizon, and goals. Diversification across asset classes is often recommended to manage risk effectively.

Tax planning is yet another critical component that should not be overlooked. By understanding tax laws and utilizing appropriate strategies such as tax-efficient investments or deductions, individuals can optimize their tax liabilities and maximize savings.

Estate planning is essential for individuals who wish to protect their assets and ensure their loved ones are taken care of after they pass away. This includes creating wills, establishing trusts if necessary, naming beneficiaries on accounts, and considering philanthropic endeavors.

Lastly, regular monitoring and review are crucial components of any successful financial plan. Financial situations change over time due to various factors like career advancements or economic fluctuations. By regularly reviewing the plan’s progress and making necessary adjustments along the way ensures it remains relevant in achieving desired outcomes.

A comprehensive financial plan consists of various key components, including goal setting, financial assessment, risk management, investment planning, tax planning, estate planning, and ongoing monitoring. Integrating these elements into a well-rounded strategy can provide individuals and businesses with the foundation they need to achieve financial success and security.

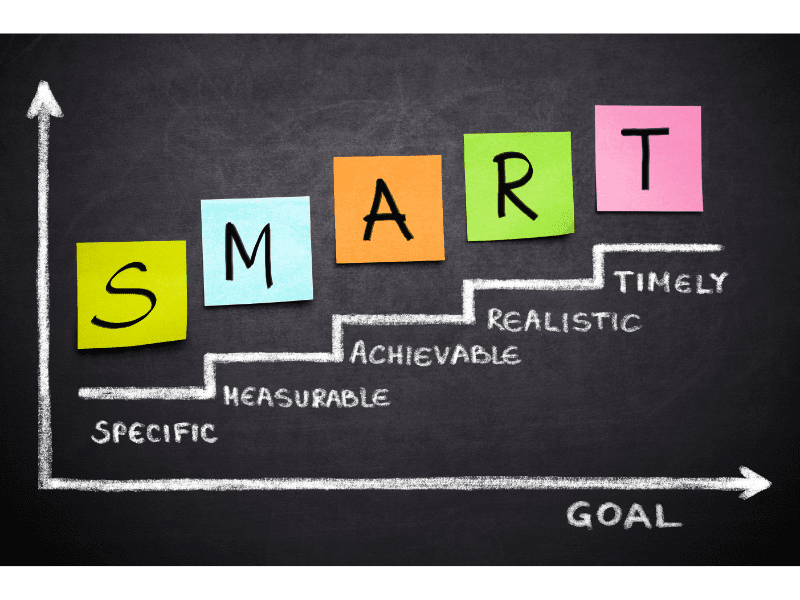

Setting SMART Goals: How to Define and Prioritize Your Financial Objectives

In the realm of financial planning, setting SMART goals is a crucial step towards achieving long-term success. By defining and prioritizing your financial objectives, you can create a clear roadmap to guide your financial decisions and ensure that you are making progress towards your desired outcomes.

SMART goals, an acronym for Specific, Measurable, Achievable, Relevant, and Time-bound, provide a framework that helps you set meaningful and actionable objectives. When it comes to financial planning, this approach becomes even more vital as it allows you to align your goals with your resources and time constraints.

Defining your financial objectives involves identifying what you want to achieve financially in both the short and long term. It could be saving for retirement, paying off debt, buying a house or car, or starting a business. Once you have identified these goals, the next step is to prioritize them based on their importance and feasibility.

Prioritizing financial goals requires evaluating each objective in terms of its urgency and impact on your overall financial well-being. Some goals may take precedence over others due to their immediate significance or potential long-term benefits. By assigning priority levels to each goal, you can allocate resources effectively and focus on what matters most at any given time.

Setting SMART goals in financial planning is essential for defining clear objectives and prioritizing them effectively. By following this approach, you can navigate the complexities of personal finance with confidence while working towards achieving your dreams and securing a stable future.

The Role of Budgeting in Creating an Effective Financial Plan

Budgeting plays a crucial role in creating an effective financial plan. It is the foundation upon which a solid financial strategy is built. By carefully managing and allocating resources, individuals can gain control over their finances and work towards achieving their financial goals.

In personal finance, budgeting serves as a roadmap for managing income and expenses. It allows individuals to track their spending habits, identify areas of overspending, and make necessary adjustments to ensure that they are living within their means. By creating a realistic budget, individuals can prioritize their financial obligations, such as saving for emergencies or retirement, paying off debt, or investing in long-term goals.

Furthermore, budgeting enables individuals to have a clear understanding of where their money is going and empowers them to make informed decisions about their spending habits. It helps in identifying unnecessary expenses and finding ways to cut back on non-essential items, thus freeing up funds for more important financial priorities.

A well-crafted budget also promotes discipline and accountability. It encourages individuals to stick to their financial plan by providing guidelines on how much money should be allocated towards different categories such as housing, transportation, groceries, entertainment, etc. By adhering to the budget consistently over time, individuals can develop healthy financial habits that lead to long-term success.

In summary, budgeting is an essential component of effective financial planning. It allows individuals to manage their finances wisely by providing structure and guidance in allocating resources. By creating a realistic budget and diligently following it, one can achieve financial stability and work towards realizing their long-term goals with confidence.

Investment Strategies: Growing Your Wealth Through Smart Investment Choices

In today’s fast-paced world, smart investment choices have become more crucial than ever for individuals looking to grow their wealth. With a myriad of investment options available in financial planning, it is essential to adopt effective investment strategies that align with your long-term goals.

One of the key aspects of successful wealth growth is identifying the right investment options. Whether you are planning for retirement, saving for your child’s education, or simply aiming to build a substantial portfolio, understanding the different avenues available can make a significant difference.

Investing for long-term goals requires a well-thought-out strategy that takes into account factors such as risk tolerance, time horizon, and desired returns. It is important to diversify your investments across various asset classes such as stocks, bonds, real estate, and even alternative investments like cryptocurrencies or startups.

Furthermore, staying informed about market trends and economic indicators can help you make informed decisions when it comes to allocating your funds. Regularly reviewing and rebalancing your portfolio ensures that it remains aligned with your changing financial goals and market conditions.

By adopting these investment strategies and making prudent choices based on thorough research and analysis, you can pave the way for growing your wealth steadily over time. Remember that investing is a long-term journey that requires patience, discipline, and adaptability. With the right approach and guidance from financial experts if needed, you can set yourself up for financial success in the future.

Risk Management: Protecting Yourself and Your Finances from Unexpected Events

In today’s uncertain world, it is crucial to prioritize risk management in your financial planning. By taking proactive steps to protect yourself and your finances from unexpected events, you can safeguard your future and ensure peace of mind.

One key aspect of risk management in finance is having the right insurance coverage. Insurance acts as a safety net, providing financial protection against unforeseen circumstances such as accidents, illnesses, or natural disasters. By carefully assessing your needs and choosing appropriate policies, you can mitigate potential financial losses that could otherwise have a significant impact on your financial well-being.

Another important element of risk management is establishing emergency funds and contingency plans. Life is full of unexpected twists and turns, and having a cushion of savings specifically designated for emergencies can help you navigate through challenging times without depleting your regular savings or going into debt. Additionally, developing contingency plans for various scenarios can provide a roadmap for action when faced with unexpected events.

By incorporating risk management strategies into your financial plan, you are taking proactive steps to protect yourself against potential pitfalls that could derail your financial stability. Remember, it’s not just about managing risks; it’s about ensuring that you have the necessary safeguards in place to weather any storm that comes your way.

Evaluating and Updating Your Financial Plan Regularly for Continued Success

In the ever-changing landscape of finance, it is crucial to regularly evaluate and update your financial plan to ensure continued success. Just as circumstances in life and the economy evolve, so should your approach to managing your finances.

Reviewing your financial plan periodically allows you to assess its effectiveness and make necessary adjustments. By analyzing your current financial situation, goals, and objectives, you can identify any gaps or areas that require attention. This proactive approach ensures that you stay on track towards achieving your financial aspirations.

Flexibility is a key component of a successful financial plan. Life is unpredictable, and unexpected events can impact our finances. By building flexibility into your plan, you can adapt to changing circumstances with ease. Whether it’s a career change, unexpected expenses, or shifts in the market, having a flexible financial strategy allows you to navigate these challenges effectively.

Updating your financial plan also enables you to take advantage of new opportunities as they arise. As technology advances and new investment options emerge, staying informed and adjusting your strategy accordingly can lead to greater returns and long-term success.

Remember that evaluating and updating your financial plan should be an ongoing process rather than a one-time event. Regularly reviewing and adjusting your plan ensures that it remains aligned with your goals while accommodating any changes in personal circumstances or market conditions.

By periodically reviewing and updating your financial plan while embracing flexibility, you can position yourself for continued success in an ever-changing financial landscape. Stay proactive, stay adaptable – and watch as your financial dreams become reality.

Taking Control of Your Finances with an Effective Financial Plan

In conclusion, implementing an effective financial plan is crucial for taking control of your finances and achieving your financial goals. A well-crafted financial plan allows you to have a clear understanding of your current financial situation and helps you make informed decisions about budgeting, saving, and investing.

By creating a comprehensive budget as part of your financial plan, you can track your income and expenses and identify areas where you can cut back or save more. This enables you to allocate your resources wisely and prioritize your spending based on your goals and priorities.

Furthermore, an effective financial plan emphasizes the importance of saving for both short-term emergencies and long-term goals. It encourages disciplined savings habits by setting aside a portion of your income regularly. This not only provides a safety net but also allows you to build wealth over time through compounding interest.

Investing is another critical aspect of an effective financial plan. By diversifying your investments across different asset classes such as stocks, bonds, or real estate, you can potentially earn higher returns while managing risk. A well-designed investment strategy aligns with your risk tolerance and long-term objectives.

In summary, taking control of your finances requires the implementation of an effective financial plan that encompasses budgeting, saving, and investing. With careful planning and disciplined execution, you can achieve financial stability and work towards achieving your dreams and aspirations. Start today by creating a personalized financial plan tailored to your unique circumstances – it’s never too late to take charge of your financial future!

Also Read: UNDERSTANDING FINANCIAL GOALS: DEFINITION, AND SHORT-TERM VS. LONG-TERM GOALS

2 thoughts on “Financial Plan Definition: Understanding the Essence of Financial Planning 2024”