What is Investment Risk Tolerance?

Investment risk tolerance refers to an individual’s ability and willingness to withstand fluctuations in the value of their investments. It is an essential aspect of financial planning and investment decision-making. Understanding your risk tolerance is crucial as it helps you align your investment strategy with your personal goals and comfort level.

Risk tolerance assessment tools are commonly used to determine an individual’s risk tolerance level. These tools take into account factors such as age, investment experience, financial goals, time horizon, and emotional capacity for market volatility. By assessing these factors, investors can gain insights into their risk appetite and make informed decisions about asset allocation and portfolio diversification.

It’s important to note that everyone’s risk tolerance varies. Some individuals may be more comfortable with taking on higher levels of risk in pursuit of potentially higher returns, while others may prefer a more conservative approach with lower-risk investments.

Understanding your own risk tolerance is crucial for successful investing. It allows you to strike a balance between achieving your financial goals and managing potential losses during market downturns. By knowing your risk tolerance, you can create a well-diversified portfolio that aligns with your comfort level and long-term objectives.

In the following sections, we will explore different aspects of investment risk tolerance in more detail, including its importance in financial planning and strategies for assessing and managing it effectively.

Table of Contents

The Crucial Role of Assessing Risk Tolerance in Developing Your Investment Strategy

Assessing your risk tolerance is a crucial step in developing an effective investment strategy that aligns with your financial goals. Understanding your risk profile helps you make informed decisions about how much risk you are willing and able to take on in pursuit of potential returns.

Investment risk assessment involves evaluating various factors such as your time horizon, financial situation, and investment objectives. By assessing these factors, you can determine the level of risk that is suitable for you.

It is important to note that everyone’s risk tolerance is unique and can vary depending on individual circumstances. Some individuals may be comfortable with higher levels of risk in exchange for potentially higher returns, while others may prefer a more conservative approach to protect their capital.

By understanding your risk tolerance, you can tailor your investment strategy accordingly. This includes selecting investments that align with your comfort level and diversifying your portfolio to manage risks effectively.

Regularly reassessing your risk tolerance is also essential as it may change over time due to various factors such as changes in financial circumstances or shifting investment goals. By periodically reviewing and adjusting your risk profile, you can ensure that your investment strategy remains aligned with your evolving needs and objectives.

Assessing your risk tolerance plays a vital role in determining the appropriate level of investment risk for you. It enables you to develop a well-rounded investment strategy that balances potential returns with the preservation of capital, ultimately helping you achieve your financial goals.

Determining Your Risk Tolerance Level

Determining your risk tolerance level is an important step in creating a successful investment strategy. Several factors should be considered when evaluating your risk tolerance:

- Financial goals and time horizon: Assessing your financial goals, whether short-term or long-term, can help determine the level of risk you are comfortable with. Consider how much time you have to reach these goals and whether you can afford to take on more risk in pursuit of higher returns.

- Comfort with volatility and uncertainty: Some individuals may feel anxious or uncomfortable with market fluctuations and uncertainties. It’s important to evaluate how well you handle these situations as they can impact your ability to stay invested during turbulent times.

- Previous investment experiences: Your past experiences with investments, both positive and negative, can provide insights into how comfortable you are taking risks. If you have a history of being conservative or aggressive in your investment choices, this knowledge can help shape your risk tolerance level.

- Personal financial situation and income stability: Consideration should be given to your current financial situation, including income stability and overall net worth. If you have a stable income stream or significant assets that provide a safety net, it may allow for greater tolerance for risk-taking.

- Investment objectives: Clearly defining your investment objectives is crucial when determining your risk tolerance level. Different investment objectives require different levels of risk exposure; conservative investors typically prioritize capital preservation while aggressive investors seek higher returns at the expense of increased volatility.

- Investor profile: Understanding what type of investor you are – conservative, moderate, or aggressive – helps establish an appropriate level of risk that aligns with your preferences and temperament.

Taking all these factors into account will help assess where on the spectrum between conservative investing (lower-risk) to aggressive investing (higher-risk) you fall within terms of both desired returns and acceptable volatility levels.

Understanding the relationship between risk and potential returns is crucial for investors and individuals looking to make informed financial decisions. The risk-return tradeoff refers to the concept that higher potential returns are typically associated with higher levels of risk.

When it comes to investments, it is important to consider both the expected return and the level of risk involved. Investors often have performance expectations for their investments, hoping to achieve a certain level of return. However, it is essential to recognize that higher returns usually come with a greater degree of risk.

Risk management strategies play a vital role in balancing the potential for returns with the level of risk an investor is willing to undertake. These strategies aim to minimize or mitigate risks while still allowing for potential gains. Diversification, asset allocation, and hedging are some commonly employed techniques in managing investment risks.

Investors must carefully assess their risk tolerance and investment goals when making decisions about allocating their funds. By understanding the relationship between risk and potential returns, individuals can make more informed choices that align with their financial objectives while effectively managing their exposure to risks in the market.

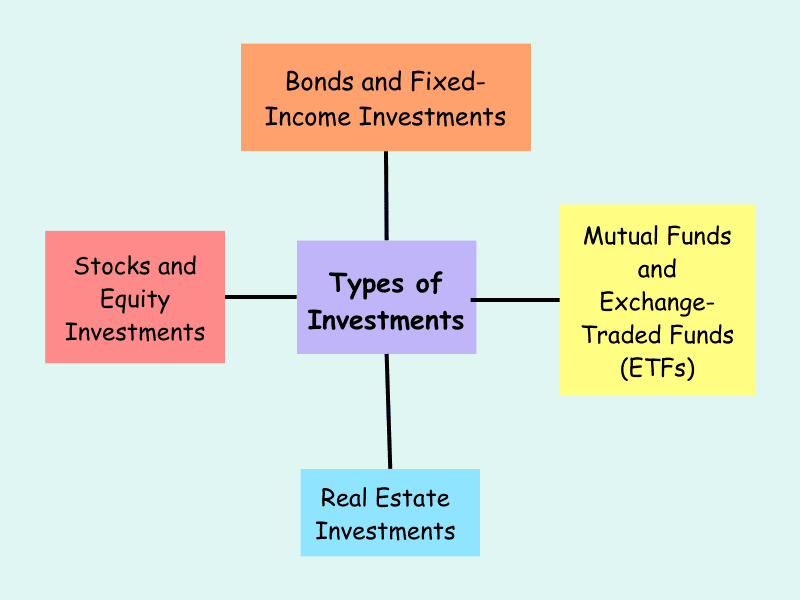

Different Types of Investments and Their Associated Risks

When it comes to investing, there are various types of investments you can consider. Let’s explore some common ones and their associated risks:

- Stocks and Equity Investments: Investing in individual company stocks or equity funds gives you ownership in a company and the potential for capital appreciation. However, stock prices can be volatile, influenced by market conditions, economic factors, and company-specific risks.

- Bonds and Fixed-Income Investments: Bonds are debt securities issued by governments or corporations. They offer regular interest payments over a fixed period of time and return the principal amount at maturity. While generally considered less risky than stocks, bond prices can fluctuate due to changes in interest rates or creditworthiness of the issuer.

- Mutual Funds and Exchange-Traded Funds (ETFs): These investment vehicles pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other assets. They provide instant diversification but still carry risks associated with the underlying assets they hold.

- Real Estate Investments: Investing in real estate involves purchasing properties for rental income or capital appreciation potential. It can provide steady cash flow but is subject to market fluctuations and various risks like vacancies, maintenance costs, regulatory changes, or economic downturns.

- Risk Diversification: To mitigate risk when investing across different asset classes like stocks, bonds, mutual funds/ETFs or real estate investments it is important to diversify your portfolio effectively – spreading your investments across a range of assets with varying risk levels helps reduce exposure to any single investment’s upsides or downsides.

- Asset Allocation Strategy: Asset allocation refers to how you distribute your investments among different asset classes based on your risk tolerance and financial goals. By choosing an appropriate mix of stocks, bonds, cash, and other assets that align with your objectives, you aim to balance potential returns against acceptable levels of risk as per one’s investment horizon, time frame, tolerance level etc.

Remember that all investments come with some level of risk, and it’s important to do thorough research, consider your risk tolerance, and possibly consult with a financial advisor before making any investment decisions.

Tips for Managing Investment Risk Based on Your Tolerance Level (Conservative vs. Moderate vs. Aggressive)

Managing investment risk is crucial regardless of your tolerance level, whether you consider yourself a conservative, moderate, or aggressive investor. Here are some tips tailored to each type of investor:

Conservative Investors:

- Diversify your portfolio: Allocate your investments across different asset classes such as stocks, bonds, real estate investment trusts (REITs), and cash equivalents. This can help reduce the impact of any single investment on your overall portfolio.

- Focus on low-risk assets: Prioritize investments with lower volatility and stable returns, such as government bonds or blue-chip stocks from established companies.

- Consider income-generating investments: Look for dividend-paying stocks or fixed-income securities that generate regular income.

Moderate Investors:

- Find a balance between risk and return: Invest in a diversified mix of assets that includes both low-risk and higher-risk options to achieve a balanced portfolio.

- Stay informed: Continuously educate yourself about investment strategies and market trends to make informed decisions based on changing economic conditions.

- Regularly review your portfolio allocation: Rebalance periodically to maintain your desired level of risk exposure.

Aggressive Investors:

- Embrace high-growth potential investments: Seek out higher-risk assets like growth stocks or emerging markets that offer the potential for significant returns over the long term.

- Be prepared for volatility: Understand that aggressive investing involves greater price fluctuations and be prepared to withstand short-term market turbulence.

- Monitor performance closely: Keep a close eye on your investments and adjust accordingly if they deviate significantly from expected outcomes.

Regardless of your tolerance level, there are important general strategies for managing investment risk:

- Educate Yourself about Investments:Stay up-to-date with financial news, market trends, and investment principles so you can make informed decisions based on accurate information rather than speculation.

- Set Realistic Expectations:Avoid falling into the trap of expecting quick gains or trying to time the market perfectly. Be patient and focus on long-term goals, understanding that investing involves both ups and downs.

- Regularly Review and Adjust Your Portfolio:Rebalance your portfolio periodically to maintain your desired risk levels and align with your investment goals. This helps ensure that your asset allocation remains in line with your tolerance for risk.

Remember, it is always advisable to consult a financial advisor who can provide personalized advice based on your specific circumstances and goals.

Achieving Long-Term Success: Striking the Right Balance Between Risk and Reward in Investments

Finding the right balance between risk and reward in your investments is crucial for long-term success. It starts with understanding your investment risk tolerance, which is a measure of how comfortable you are with the potential ups and downs of the market.

When making investment decisions, it’s important to consider your risk tolerance along with your long-term investing goals. This involves assessing the potential risks associated with different investment options and weighing them against the potential rewards.

While taking on more risk can potentially lead to higher returns, it’s important to remember that higher returns also come with a higher level of volatility. On the other hand, being too conservative may limit your growth potential.

To strike a balance between risk and reward, it’s essential to have a well-defined investment decision-making process. This includes conducting thorough research, diversifying your portfolio across different asset classes, regularly reviewing and adjusting your investments based on market conditions, and staying focused on long-term goals rather than short-term fluctuations.

Ultimately, finding the right balance between risk and reward requires careful consideration of your individual circumstances and financial objectives. By understanding your risk tolerance and following a disciplined approach to investing, you can navigate the investment landscape effectively while maximizing long-term growth potential.

Also Read: Understanding Risk vs. Reward: A Guide to Successful Investing

2 thoughts on “Understanding Investment Risk Tolerance: A Guide for Investors”