Embarking on the journey of investing often involves navigating a complex landscape of financial instruments. One powerful and accessible tool in this realm is the mutual fund. Imagine pooling resources with a multitude of investors, and entrusting your funds to skilled professionals managing a diversified portfolio of stocks, bonds, or other securities.

This is the essence of mutual funds – a collective approach to investing that opens doors for both novice and experienced investors.

In this guide, we’ll demystify mutual funds, exploring their advantages, types, and how they work, empowering you to make informed and strategic investment decisions. Welcome to the world of mutual funds, where your journey to financial growth begins.

Table of Contents

Definition and purpose of mutual funds

Mutual funds, financial powerhouses that bring together the aspirations of numerous investors, represent a collective approach to wealth building. The core purpose of mutual funds is to pool resources from a multitude of individuals and channel them into a professionally managed portfolio of stocks, bonds, or a blend of various securities.

This collective investment strategy offers a range of benefits, including professional asset management, diversification, and accessibility for even the smallest investors.

Whether you’re a seasoned investor or just stepping into the financial arena, mutual funds provide a gateway to diversified and managed investments, making them a cornerstone of many successful portfolios.

Embarking on a journey through the annals of financial history, mutual funds emerge as resilient pillars of investment evolution.

The roots of mutual funds trace back to the early 18th century, gaining prominence in the 1920s with the establishment of the first modern mutual fund. MFS Investment Management laid the foundation in 1924, introducing the Massachusetts Investors Trust. Since then, these financial instruments have weathered economic storms, adapting to the shifting landscapes of global markets.

The mutual fund landscape has flourished, fostering a plethora of fund types catering to diverse investor needs. Understanding the historical trajectory of mutual funds unveils their enduring significance, shaping the landscape of accessible and diversified investments we recognize today.

Advantages of Mutual Funds

At the heart of the allure of mutual funds is the artistry of professional asset management. Skilled fund managers, armed with a nuanced understanding of market intricacies, assume the mantle of guardians for investors’ capital.

Their role transcends the mere buying and selling of securities; it’s a strategic dance across the volatile landscape of financial markets. Armed with experience and insight, these managers diligently analyze market trends, assess risks, and identify opportunities.

Investors, whether seasoned or fledgling, benefit from this seasoned guidance, entrusting their financial voyage to the hands of those well-versed in the art of wealth navigation.

Mutual funds unfurl the banner of diversification, a powerful shield against the storms of market volatility. Investors, regardless of their financial acumen, can spread their capital across a multitude of assets, stocks, bonds, or both within a single fund.

This strategic dispersion acts as a financial safety net, cushioning the impact of a downturn in any particular investment. Diversification is the alchemy that transforms risk into a mosaic of opportunity, ensuring that no single market ripple can capsize the entire portfolio.

It’s a cornerstone principle, championed by mutual funds, fostering resilience in the face of an ever-changing financial seascape.

Mutual funds, with their inclusive ethos, beckon even the smallest investors to the grand stage of financial growth. The beauty lies in accessibility; a modest investment grants entry into a diversified portfolio managed by seasoned professionals. Small investors no longer stand on the sidelines; they actively participate in a realm traditionally dominated by larger players.

This democratization of wealth creation paints a landscape where financial opportunities are not confined by the size of one’s purse. Mutual funds extend an inviting hand, bridging the gap between aspiration and achievement, allowing individuals of all financial statures to partake in the symphony of investment.

Mutual funds not only promise potential returns but also bestow investors with the gift of liquidity and seamless transactions. Unlike some investments that tie capital in lengthy processes, mutual funds offer an escape route. Need to liquidate your investment or purchase additional units? The process is swift, allowing investors the freedom to adapt to changing financial circumstances.

This liquidity, coupled with the ease of buying and selling, empowers individuals to navigate their financial journey with agility, making mutual funds a dynamic choice in the ever-evolving landscape of investment opportunities.

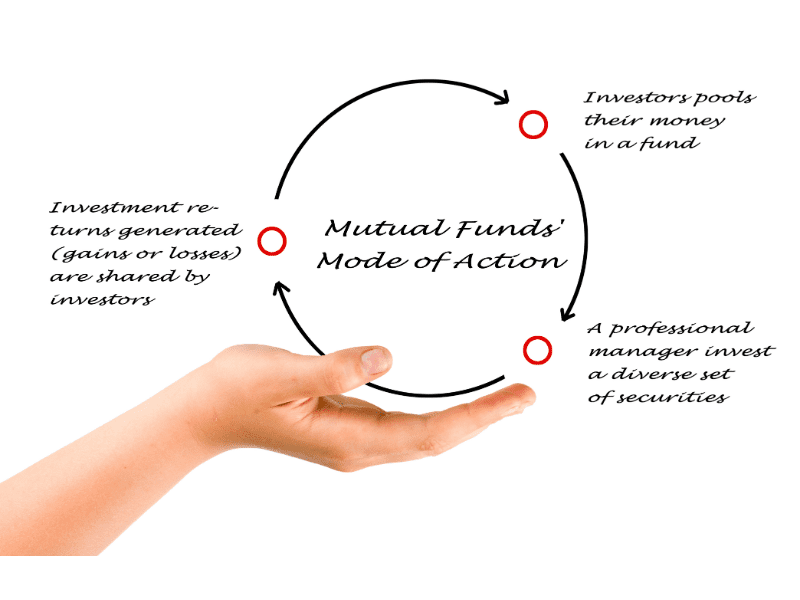

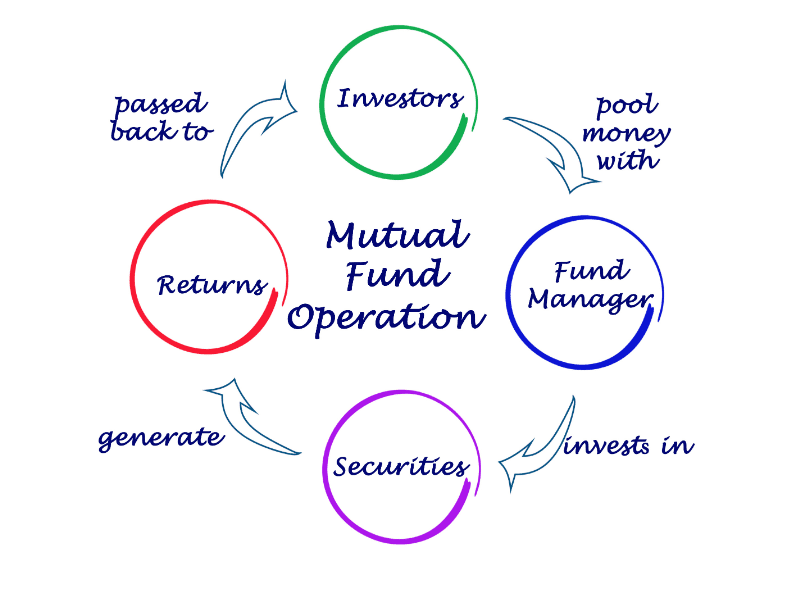

How Mutual Funds Work

Mutual funds embody the spirit of collaboration, where investors unite their financial notes to create a harmonious melody of wealth accumulation. By pooling funds from a diverse array of contributors, these funds ensure that even modest investors can participate in a shared investment journey. This collaborative approach not only fosters inclusivity but also leverages the strength of many to navigate the complexities of financial markets, creating a powerful ensemble working towards shared prosperity.

Enter the maestros of the financial world – fund managers. Tasked with orchestrating the investment symphony, these professionals are the guiding hands behind the scenes. From selecting the right instruments (assets) to determining the tempo (risk management) and achieving the perfect harmony (returns), fund managers bring expertise and insight to the performance.

Their role is pivotal in translating the collective investment vision into a well-executed masterpiece that resonates with success.

In the world of mutual funds, investors encounter various compositions. Open-ended funds, flexible with shares issued and redeemed based on demand, provide fluidity. Closed-ended counterparts issue a fixed number of shares, often traded on exchanges like stocks.

For the digitally inclined, Exchange-Traded Funds (ETFs) blend mutual fund and stock features, traded throughout the day. Each type offers a unique melody in the investment symphony, catering to diverse preferences and strategies.

At the heart of mutual fund valuation lies the Net Asset Value (NAV). This financial heartbeat represents the per-share market value of the fund’s assets. Calculated daily, NAV divides the total value of assets by the number of outstanding shares.

It’s akin to determining the worth of a slice in a communal investment pie. Investors buy or redeem shares based on NAV, creating a transparent pricing mechanism. As NAV fluctuates, it reflects the fund’s performance, guiding investors through the dynamic landscape of mutual fund investments.

Types of Mutual Funds

Embarking on your investment journey can be both exciting and overwhelming, but mutual funds offer a fantastic entry point into the world of investing with their diversified and professionally managed portfolios.

There are various types of mutual funds, each tailored to different investor preferences and financial goals. Equity mutual funds primarily invest in stocks, offering higher risk but the potential for higher returns. Debt mutual funds focus on fixed-income securities, providing lower risk and stable returns. Hybrid or balanced funds strike a middle ground, blending equity and debt instruments for a moderate risk-return profile. Index funds replicate specific market indices with lower risk due to passive management. Sectoral funds concentrate on specific industries, offering higher risk and potential for growth. Tax-saving (ELSS) funds provide tax benefits with a three-year lock-in period. Liquid funds invest in short-term money market instruments, offering high liquidity.

- Equity Mutual Funds:

- Objective: Primarily invest in stocks or equities.

- Risk-Reward Profile: Higher risk, potentially higher returns.

- Ideal for: Investors seeking long-term capital appreciation and willing to withstand market volatility.

- Debt Mutual Funds:

- Objective: Invest in fixed-income securities like bonds, government securities, and money market instruments.

- Risk-Reward Profile: Lower risk compared to equity funds, with relatively stable returns.

- Ideal for: Those looking for regular income and capital preservation.

- Hybrid or Balanced Mutual Funds:

- Objective: Blend of equity and debt instruments to provide a balanced risk-return profile.

- Risk-Reward Profile: Moderate risk with a mix of growth and income.

- Ideal for: Investors seeking a balanced approach, combining capital appreciation and income generation.

- Index Mutual Funds:

- Objective: Replicate the performance of a specific market index (e.g., Nifty, S&P 500).

- Risk-Reward Profile: Generally lower risk due to passive management.

- Ideal for: Investors looking for broad market exposure with lower expense ratios.

- Sectoral Mutual Funds:

- Objective: Concentrate investments in specific sectors like technology, healthcare, or energy.

- Risk-Reward Profile: Higher risk due to sector concentration, potential for higher returns if the chosen sector performs well.

- Ideal for: Investors with a strong belief in the growth potential of a particular industry.

- Tax-Saving (ELSS) Mutual Funds:

- Objective: Invest with a three-year lock-in period, offering tax benefits under Section 80C of the Income Tax Act.

- Risk-Reward Profile: Linked to the equity market, hence higher risk.

- Ideal for: Individuals looking to save on taxes while participating in equity market growth.

- Liquid Mutual Funds:

- Objective: Invest in short-term money market instruments, offering high liquidity.

- Risk-Reward Profile: Low risk with relatively lower returns.

- Ideal for: Investors seeking a safe parking place for surplus funds with quick access.

Understanding these options allows investors to align their choices with their financial goals and risk tolerance, creating a well-rounded investment strategy for a prosperous financial future.

Investment Strategies in Mutual Funds

The journey of wealth creation through mutual funds requires a strategic approach, and understanding various investment strategies can empower investors to make informed decisions aligned with their financial goals.

One effective strategy is the Systematic Investment Plan (SIP), allowing for regular investments at predetermined intervals and mitigating the impact of market volatility through rupee cost averaging. For those seeking a steady income stream, the Systematic Withdrawal Plan (SWP) provides a methodical way to withdraw fixed amounts at regular intervals.

Alternatively, lump-sum investments suit individuals with a substantial amount to invest, offering immediate exposure to market opportunities. Asset allocation and dynamic asset allocation strategies aim to balance risk and growth by diversifying investments across different asset classes and adjusting allocations based on market conditions.

Sector rotation capitalizes on sector-specific growth opportunities, while top-down and bottom-up approaches offer flexibility in aligning with macroeconomic trends or specific stock selection. Value investing targets undervalued assets for long-term appreciation, and tax planning strategies, such as investing in tax-saving mutual funds (ELSS), maximize post-tax returns.

Ultimately, successful mutual fund investing stems from aligning these strategies with individual financial objectives, risk tolerance, and time horizon, with the guidance of a financial advisor contributing to a well-rounded approach to financial prosperity

Tips for Investing in Mutual Funds

Embarking on the journey of mutual fund investments can be a rewarding endeavor when approached with knowledge and strategy. Here are some essential tips to guide you towards successful mutual fund investing and help you make informed decisions in the dynamic world of finance.

- Define Your Financial Goals: Clearly articulate your financial objectives, whether it’s wealth creation, funding education, or retirement planning. Understanding your goals will guide your investment choices and risk tolerance.

- Understand Your Risk Tolerance: Assess your comfort level with risk. Mutual funds come with varying degrees of risk, and aligning your risk tolerance with the fund’s risk profile is crucial for a harmonious investment experience.

- Diversify Your Portfolio: Spread your investments across different asset classes, such as equities, debt, and money market instruments. Diversification helps mitigate risk and enhances the potential for stable returns.

- Research and Due Diligence: Conduct thorough research on the mutual funds you are considering. Analyze historical performance, fund manager expertise, expense ratios, and the fund’s investment strategy. Past performance is not a guarantee, but it provides valuable insights.

- Choose the Right Fund Category: Select mutual fund categories that align with your financial goals and risk tolerance. Whether it’s equity funds for growth or debt funds for stability, understanding each category’s characteristics is essential.

- Consider Expense Ratios: Pay attention to the fund’s expense ratio, which represents the percentage of assets deducted annually for management fees. Lower expense ratios can contribute to higher overall returns for investors.

- Regularly Review and Rebalance: Periodically review your mutual fund portfolio to ensure it aligns with your goals. Rebalance your portfolio if needed, especially after significant market movements, to maintain the desired asset allocation.

- Stay Informed about Market Trends: Keep yourself updated on economic trends, market conditions, and global events that may impact your investments. Staying informed allows you to make timely decisions and adjust your strategy as needed.

- Consider Systematic Investment Plans (SIPs): Implementing SIPs allows you to invest a fixed amount at regular intervals, promoting disciplined and systematic investing while mitigating the impact of market volatility.

- Patience is Key: Mutual fund investments are designed for the long term. Avoid making impulsive decisions based on short-term market fluctuations. Patience can be a key factor in realizing the full potential of your investments.

Mutual fund investing can be a powerful tool for building wealth and achieving financial goals. By defining your objectives, understanding risk, diversifying your portfolio, and staying informed, you set the stage for a successful investment journey. Remember, consistency, and patience are virtues in the world of mutual funds

In conclusion, embarking on the journey of understanding mutual funds as a beginner opens the door to a world of financial possibilities. This comprehensive guide has provided key insights, emphasizing the importance of setting clear financial goals, assessing risk tolerance, and diversifying investments. Armed with knowledge on researching funds, considering expense ratios, and staying informed about market trends, beginners can navigate the world of mutual funds with confidence.

Whether opting for systematic investment plans (SIPs) or embracing the virtue of patience, this beginner’s guide lays the foundation for a successful and informed investment journey. As you venture forth, remember that mutual fund investing is a long-term commitment, and the principles outlined here will serve as valuable companions on your path to financial growth and prosperity. Happy investing!

Also Read: 10 Best Ways to Save Money 2023

4 thoughts on “Understanding Mutual Funds: A Beginner’s Guide”