Why Investing is the Key to Building Wealth

In today’s fast-paced and ever-changing world, building wealth has become a top priority for many individuals. While there are various paths to financial freedom, one key element stands out: investing. Investing offers a powerful tool that allows you to grow your money and create a solid foundation for long-term wealth accumulation.

Investing is not just reserved for the wealthy or financial experts; it is accessible to anyone with the desire to secure their financial future. Whether you have just started your career or are nearing retirement, understanding the importance of investing and implementing effective investment strategies can make all the difference in achieving your financial goals.

The concept of investing revolves around putting your money to work by allocating it into different assets such as stocks, bonds, real estate, or mutual funds. By doing so, you give your money the opportunity to grow over time through capital appreciation and earning potential.

One of the primary reasons why investing is crucial in building wealth is its ability to generate passive income. Unlike relying solely on a fixed salary or traditional savings accounts with minimal interest rates, investments can provide an additional stream of income that works for you even when you’re not actively working. This passive income can be reinvested or used to cover expenses, ultimately accelerating your journey towards financial independence.

Moreover, investing allows you to harness the power of compounding returns. As your investments generate earnings over time, these earnings can be reinvested back into your portfolio, creating a snowball effect where your money starts working harder for you. The longer you stay invested and allow compounding to take effect, the greater potential for exponential growth in wealth.

However, successful investing requires careful planning and informed decision-making. It’s essential to develop a well-rounded investment strategy that aligns with your risk tolerance, financial goals, and time horizon. Diversification across different asset classes can help mitigate risks while maximizing potential returns.

In this section on “Why Investing is the Key to Building Wealth,” we will explore various investment strategies, delve into the benefits of investing, and provide practical insights on how you can start your investment journey. By understanding the power of investing and implementing sound financial strategies, you can pave the way towards a brighter financial future and unlock the doors to long-term wealth accumulation.

Table of Contents

The Different Types of Investments and Their Pros and Cons

Investing is a crucial aspect of building wealth and securing a financially stable future. However, with so many options available, it can be overwhelming to decide where to allocate your hard-earned money. In this section, we will explore the different types of investments and their respective pros and cons.

- Stocks: Investing in stocks means buying shares of ownership in a company. The potential for high returns makes stocks an attractive investment option. However, they also come with higher risks due to market volatility and the possibility of losing money.

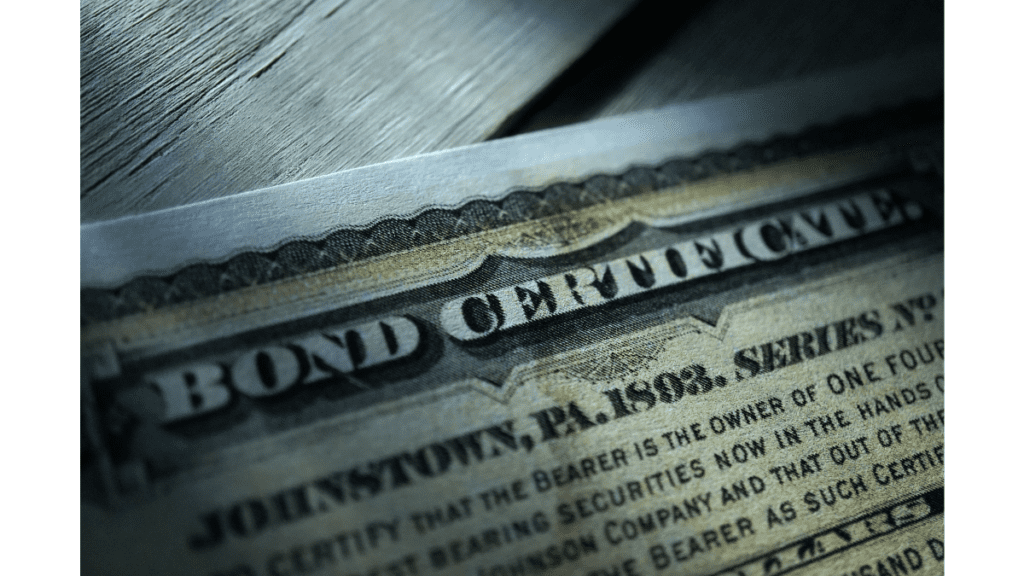

- Bonds: Bonds are debt instruments issued by governments or corporations to raise capital. They offer fixed interest payments over a specific period, making them more predictable than stocks. While bonds provide stability and income generation, their returns may be lower compared to other investment options.

- Real Estate: Investing in real estate involves purchasing properties for rental income or capital appreciation. Real estate can provide steady cash flow and long-term growth potential. However, it requires significant upfront capital, ongoing maintenance costs, and market fluctuations can impact property values.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets managed by professionals. They offer diversification benefits and professional management but come with fees that can eat into returns.

- Index Funds: Index funds are a type of mutual fund that aims to replicate the performance of a specific market index like the S&P 500. They offer broad market exposure at low costs compared to actively managed funds but may limit potential gains if the index underperforms.

- Cryptocurrencies: Cryptocurrencies like Bitcoin have gained significant attention as digital assets with potential for high returns. However, they are highly volatile and speculative investments that carry substantial risks due to regulatory uncertainties and market fluctuations.

Each investment option has its own set of advantages and disadvantages based on factors such as risk tolerance, financial goals, time horizon, and market conditions. It is crucial to carefully consider these factors and seek professional advice before making any investment decisions.

Stocks: The Power of Owning a Piece of a Company

Investing in the stock market offers individuals the opportunity to own a piece of a company and gain financial benefits. Stocks, also known as equities, provide investors with the potential for both dividends and capital gains, making them a powerful asset class.

When you invest in stocks, you become a shareholder of the company. This means that you have a claim on its assets and earnings. One of the primary advantages of owning stocks is the potential to receive dividends. Dividends are periodic payments made by companies to their shareholders as a share of their profits. This allows investors to earn passive income on top of any potential capital gains.

Speaking of capital gains, stocks have proven to be an excellent long-term investment strategy for wealth accumulation. As companies grow and increase their profitability, the value of their shares can appreciate over time. When you sell your shares at a higher price than what you initially paid for them, you realize capital gains.

Blue-chip stocks are particularly noteworthy in this regard. These are shares in well-established companies with a history of stable earnings and reliable dividend payments. Investing in blue-chip stocks can provide stability and consistent returns over time.

The Investing in stocks allows individuals to become part-owners of companies and benefit from both dividends and potential capital gains. Whether it’s through receiving regular income or seeing your investment grow over time, owning stocks can be a powerful tool for building wealth and achieving financial goals

Bonds: Generating Fixed Income with Less Risk

Investing in bonds can be a smart move for those looking to generate fixed income with less risk. Bonds offer a way to diversify investment portfolios and provide a steady stream of income through interest payments.

When it comes to bond investing, one important consideration is the choice between government bonds and corporate bonds. Government bonds are generally considered safer as they are backed by the full faith and credit of the government. On the other hand, corporate bonds carry slightly higher risk but also offer potentially higher returns.

Interest rates play a crucial role in bond investing. When interest rates rise, bond prices tend to fall, and vice versa. Understanding how interest rates impact bond prices is essential for investors looking to make informed decisions.

By carefully considering these factors and conducting thorough research, investors can navigate the world of bond investing with confidence. Bonds provide an opportunity to generate fixed income while minimizing risk, making them an attractive option for those seeking stability in their investment strategy.

Real Estate: Building Passive Income through Property Ownership

Investing in real estate has long been recognized as a reliable way to build passive income and secure financial stability. With the potential for steady cash flow and property appreciation, real estate ownership offers individuals the opportunity to generate wealth over time.

One of the most common methods of building passive income through real estate is by investing in rental properties. By acquiring properties and renting them out to tenants, investors can enjoy a consistent stream of rental income that can be used to cover expenses and generate profit.

For those who prefer a more hands-off approach, REITs (Real Estate Investment Trusts) provide an excellent alternative. REITs allow individuals to invest in a diversified portfolio of real estate assets without the need for direct property ownership. This allows investors to benefit from rental income and property appreciation without the responsibilities of property management.

Whether you choose to invest directly in rental properties or opt for REITs, real estate offers a tangible and proven path towards building passive income. With careful research and strategic decision-making, individuals can leverage the power of real estate investing to create long-term financial security and achieve their wealth-building goals.

Mutual Funds & Index Funds: Diversification Made Easy

In the world of investing, diversification is a key strategy for mitigating risk and maximizing returns. Mutual funds and index funds have emerged as popular options for achieving this diversification in a simple and efficient manner.

Mutual fund investing allows individuals to pool their money with other investors to create a diversified portfolio managed by professional fund managers. These funds invest in a variety of assets such as stocks, bonds, and commodities, spreading the risk across different sectors and industries.

Index fund investing takes diversification a step further by tracking specific market indexes, such as the S&P 500 or the Dow Jones Industrial Average. These funds aim to replicate the performance of these indexes, providing investors with broad exposure to a wide range of companies within the index.

The beauty of mutual funds and index funds lies in their accessibility and ease of use. Investors can start with small amounts of capital and still benefit from instant diversification across multiple securities. Additionally, these funds offer professional management expertise, saving investors time and effort in researching individual stocks or bonds.

By investing in mutual funds or index funds, individuals can achieve diversification without needing extensive knowledge or experience in financial markets. This makes them an ideal choice for both novice investors looking to get started on their investment journey and seasoned investors seeking to maintain a well-rounded portfolio.

Mutual funds and index funds provide an effortless way for individuals to achieve portfolio diversification. Whether you are new to investing or looking to enhance your existing portfolio’s risk-reward profile, these investment vehicles offer simplicity, accessibility, and the potential for long-term growth.

Cryptocurrencies: The Future of Digital Currency Investment cryptocurrency investing 101 , bitcoin , altcoins , blockchain technology

Cryptocurrencies have emerged as a fascinating and potentially lucrative investment opportunity in recent years. With the rise of Bitcoin and the advent of altcoins, investors are now exploring the world of digital currency with great interest. In this section, we will delve into cryptocurrency investing 101, shedding light on the fundamentals of this market and providing insights into how to navigate it successfully.

At the heart of cryptocurrencies lies blockchain technology, a revolutionary concept that ensures transparency, security, and decentralization. Understanding blockchain is crucial for any investor looking to venture into this space. We will explore the intricacies of blockchain technology and its role in shaping the future of digital currency investment.

Bitcoin, often referred to as the pioneer cryptocurrency, has captured global attention due to its meteoric rise in value. We will delve into what makes Bitcoin unique and discuss its potential as a long-term investment asset.

Additionally, we will explore altcoins – alternative cryptocurrencies that have gained traction alongside Bitcoin. By examining their unique features and use cases, we can uncover potential investment opportunities beyond Bitcoin.

Whether you are a seasoned investor or new to the world of digital currencies, this section will provide you with valuable insights on cryptocurrency investing. By understanding the fundamentals and staying informed about market trends, you can confidently navigate this dynamic landscape and seize opportunities for financial growth in the future. Investing in cryptocurrencies can be an exciting and potentially rewarding endeavor. Whether you are new to this space or have some experience, gaining a solid understanding of the fundamentals is crucial.

This will enable you to make informed decisions and navigate the ever-changing market with confidence. In this section, we aim to equip you with valuable insights that will help shape your cryptocurrency investment strategy. We understand that staying informed about market trends is vital for success in this dynamic landscape. Therefore, we will provide you with regular updates on the latest developments and trends in the cryptocurrency world. Our goal is to empower you to seize opportunities for financial growth in the future.

We believe that by arming yourself with knowledge, you can make well-informed investment decisions that align with your objectives. Whether it’s understanding the technology behind cryptocurrencies, analyzing market data, or exploring different investment strategies, we are here to assist you every step of the way. Our expert team is committed to delivering accurate information and guidance that will support your journey as an investor. Investing in cryptocurrencies can be both exciting and daunting at times.

However, with our assistance, we aim to simplify complex concepts and help demystify this rapidly evolving industry. Together, let’s unlock the potential of cryptocurrency investing and embark on a path towards financial growth. Feel free to explore our resources and reach out whenever you need assistance or have queries about cryptocurrency investing – we’re here for you!

7 thoughts on “An In-Depth Introduction to Investing for Success: Unlocking Financial Growth”