Understanding the Importance of Retirement Planning with Investments

Retirement planning is a crucial aspect of securing our financial future and achieving our retirement goals. It involves careful consideration of various factors, including investments, to ensure a comfortable and stress-free retirement.

Investments play a pivotal role in retirement planning as they provide the opportunity for growth and income generation over time. By strategically allocating funds into different investment vehicles, individuals can build a robust retirement savings portfolio that can withstand market fluctuations and inflation.

The importance of retirement planning with investments cannot be overstated. Without proper planning, individuals may find themselves unprepared to meet their financial needs during their golden years. By starting early and consistently contributing to their retirement savings, individuals can take advantage of the power of compounding and maximize their returns over time.

Furthermore, investments offer the potential for higher returns compared to traditional savings accounts or fixed deposits. While they do come with certain risks, proper diversification and risk management strategies can help mitigate these risks and optimize long-term growth potential.

In this section, we will explore the various aspects of retirement planning with investments. We will delve into different investment options available for building a solid retirement portfolio, discuss strategies for maximizing returns while minimizing risks, and highlight the importance of regularly reviewing and adjusting one’s investment plan as circumstances change.

By understanding the significance of retirement planning with investments, individuals can take proactive steps towards securing their financial future and ensuring a comfortable lifestyle during their post-work years. So let’s dive in further to unravel the key elements that contribute to successful retirement planning with investments.

Table of Contents

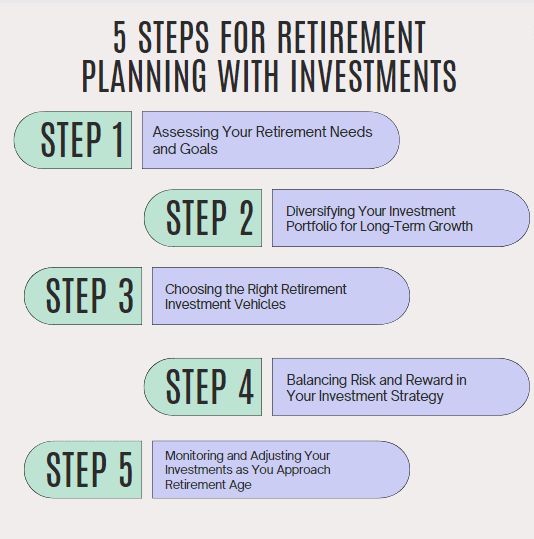

The Simple Steps Of Retirement Planning With Investments

Step 1: Assessing Your Retirement Needs and Goals

When it comes to planning for retirement, it’s crucial to start by assessing your retirement needs and goals. This step sets the foundation for creating a solid retirement plan that aligns with your aspirations and financial situation.

One of the key aspects of assessing your retirement needs is determining your retirement goals. What kind of lifestyle do you envision having during your golden years? Do you want to travel extensively, pursue hobbies, or downsize to a simpler lifestyle? Identifying these goals will help you determine the level of income you’ll need in retirement.

It’s important to consider inflation when estimating your future income needs. Over time, the cost of living tends to rise due to inflation. Therefore, it’s wise to factor in an inflation rate when calculating how much income you’ll require during retirement.

Another critical aspect is healthcare expenses. As we age, healthcare costs tend to increase. It’s essential to account for potential medical expenses and ensure that your retirement plan includes provisions for adequate healthcare coverage.

By thoroughly assessing your retirement needs and goals, including lifestyle expectations, accounting for inflation, and considering healthcare expenses, you can take proactive steps towards building a comprehensive retirement plan that provides financial security and peace of mind in your later years.

Step 2: Diversifying Your Investment Portfolio for Long-Term Growth

Diversifying your investment portfolio is a crucial step in achieving long-term growth and managing risk. By spreading your investments across different asset classes, you can potentially reduce the impact of any single investment’s performance on your overall portfolio.

One key factor to consider when diversifying is your risk tolerance. This refers to your ability and willingness to take on risk in pursuit of higher returns. Understanding your risk tolerance will help you determine the appropriate mix of assets for your portfolio.

Asset allocation is another important aspect of diversification. It involves dividing your portfolio among different types of investments, such as stocks and bonds, based on their expected returns and level of risk. This helps ensure that you have exposure to various sectors and industries, reducing the potential impact of any one investment’s performance.

Including stocks in your portfolio can provide growth potential, but they also come with higher volatility. Bonds, on the other hand, tend to be more stable but offer lower returns. Balancing these two asset classes based on your risk tolerance and financial goals is key.

Remember that diversification does not guarantee profits or protect against losses, but it can help manage risk by spreading it across different investments. Regularly reviewing and rebalancing your investment portfolio is essential to maintain its desired asset allocation over time.

Step 3: Choosing the Right Retirement Investment Vehicles

When it comes to planning for retirement, choosing the right investment vehicles is crucial. There are several options available, each with its own advantages and considerations. In this section, we will explore some of the most common retirement investment vehicles, including 401(k) plans, Individual Retirement Accounts (IRAs), Roth IRAs, annuities, and mutual funds.

A 401(k) plan is a popular employer-sponsored retirement savings account. It allows employees to contribute a portion of their salary on a pre-tax basis, which can provide immediate tax benefits. Employers may also offer matching contributions up to a certain percentage of the employee’s salary.

Individual Retirement Accounts (IRAs) are another common option for retirement savings. These accounts can be opened by individuals and offer tax advantages similar to 401(k) plans. There are two main types of IRAs: traditional IRAs and Roth IRAs.

Traditional IRAs allow individuals to make tax-deductible contributions, meaning they can lower their taxable income in the year they contribute. However, withdrawals from traditional IRAs in retirement are subject to income taxes.

On the other hand, Roth IRAs do not provide immediate tax benefits for contributions but offer tax-free withdrawals in retirement. This can be advantageous for individuals who expect their income tax rate to be higher in retirement than it is currently.

Annuities are insurance products that provide regular payments over a specified period or for life. They can be an attractive option for retirees looking for guaranteed income streams but may come with fees and restrictions on access to funds.

Mutual funds pool money from multiple investors and invest in diversified portfolios of stocks, bonds, or other assets. They offer professional management and diversification benefits but come with expenses such as management fees.

Choosing the right retirement investment vehicles requires careful consideration of your individual financial goals, risk tolerance, time horizon until retirement, and other factors specific to your situation. It’s important to consult with a financial advisor who can help you navigate the options and make informed decisions.

Step 4: Balancing Risk and Reward in Your Investment Strategy

When it comes to retirement planning, one of the key considerations is how to balance risk and reward in your investment strategy. This is an important step in ensuring that you have a solid financial foundation for your future.

One aspect of managing risk in retirement planning is deciding between conservative and aggressive investments. Conservative investments typically offer lower returns but also come with lower levels of risk. On the other hand, aggressive investments have the potential for higher returns but also carry a higher level of risk.

To strike the right balance, retirees often employ asset allocation strategies. These strategies involve diversifying their investment portfolio across different asset classes such as stocks, bonds, and cash equivalents. By spreading their investments across various assets, retirees can mitigate the impact of any single investment performing poorly.

It’s crucial for retirees to carefully assess their risk tolerance and financial goals when determining their asset allocation strategy. Factors such as age, income needs, and time horizon should all be taken into account.

Ultimately, finding the optimal balance between risk and reward in your investment strategy requires careful consideration and ongoing monitoring. Regularly reviewing your portfolio’s performance and making adjustments as needed can help ensure that you are on track to meet your retirement goals while managing potential risks effectively.

Step 5: Monitoring and Adjusting Your Investments as You Approach Retirement Age

As you approach retirement age, it becomes crucial to monitor and adjust your investments to ensure they align with your changing financial goals and risk tolerance. This step, often referred to as investment monitoring, involves regularly reviewing your portfolio and making necessary adjustments to keep it on track.

One important aspect of investment monitoring is rebalancing your portfolio. Over time, certain investments may outperform or underperform others, causing the asset allocation in your portfolio to deviate from your desired mix. Rebalancing involves selling some assets that have performed well and buying more of those that have underperformed, bringing the allocation back in line with your target.

Additionally, as retirement approaches, you may want to adjust the risk exposure in your portfolio. Generally, as you get closer to retirement age, it is advisable to gradually reduce the level of risk in your investments by shifting towards more conservative options. This can help protect the value of your savings from potential market downturns and ensure a smoother transition into retirement.

Seeking professional advice from a financial advisor or investment manager can be beneficial during this stage. They can provide valuable insights based on their expertise and help you make informed decisions about adjusting your investments. A professional can also assist in assessing whether any major life changes or financial goals require modifications to your investment strategy.

In summary, monitoring and adjusting your investments as you approach retirement age is essential for maintaining a well-balanced portfolio that aligns with your changing needs and objectives. Regularly reviewing and rebalancing your assets while considering adjustments to risk exposure can help ensure a secure financial future during this critical phase of life. Seeking professional advice further enhances the effectiveness of this process by tapping into expert knowledge tailored specifically for individual circumstances.

Taking Control of Your Financial Future through Smart Retirement Planning with Investments

Investing in your retirement is a crucial step towards securing a financially stable future. By taking control of your financial situation and making smart retirement planning decisions, you can ensure that you have enough funds to support yourself during your golden years.

One of the key aspects of smart retirement planning is investing wisely. By allocating a portion of your income towards investments, such as stocks, bonds, mutual funds, or real estate, you can potentially grow your wealth over time. These investments offer the potential for higher returns compared to traditional savings accounts or fixed deposits.

It’s important to note that investing involves risks and it’s essential to conduct thorough research and seek professional advice before making any investment decisions. Diversifying your investment portfolio can help mitigate risks and maximize potential returns.

Another important aspect of smart retirement planning is regularly reviewing and adjusting your investment strategy as per changing market conditions and personal financial goals. This ensures that you stay on track towards meeting your retirement objectives.

In conclusion, taking control of your financial future through smart retirement planning with investments is a proactive approach towards securing a comfortable retirement. By investing wisely, diversifying your portfolio, and regularly reviewing your strategy, you can increase the likelihood of achieving financial independence during your golden years. Remember to consult with financial advisors or experts who can provide guidance tailored to your specific needs and goals.

Also Read: Investing for retirement savings: A Comprehensive Guide

3 thoughts on “Retirement Planning with Investments: A Comprehensive Guide to Secure Your Financial Future”