Retirement planning is a crucial aspect of financial stability, and it holds particular significance for small business owners. As entrepreneurs, small business owners often invest their time, energy, and resources into building their businesses. However, it is equally important for them to prioritize their own future financial security.

Small business owners face unique challenges when it comes to retirement planning. Unlike employees who may have access to employer-sponsored retirement plans, small business owners must take the initiative to create and manage their own retirement savings. This requires careful financial planning and consideration of various retirement options.

By implementing effective retirement plans, small business owners can ensure that they have sufficient funds to support themselves during their golden years. Moreover, proper retirement planning can provide peace of mind and a sense of financial security for both the business owner and their loved ones.

In this section, we will explore the importance of retirement planning specifically tailored for small business owners. We will discuss various retirement options available to them and delve into the benefits of proactive financial planning. Whether you are a seasoned entrepreneur or just starting your own venture, understanding the significance of retirement planning is essential for long-term success and stability as a small business owner.

Table of Contents

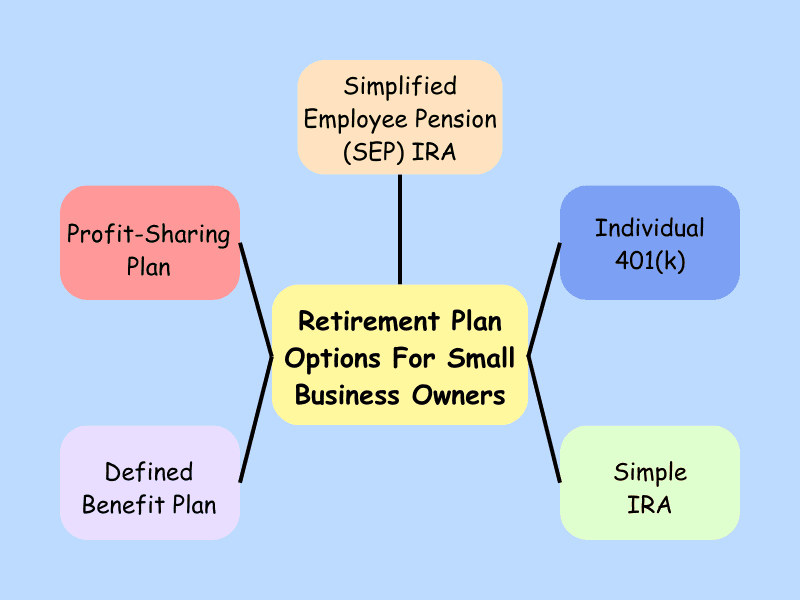

Navigating Retirement Plans for Small Business Owners: Exploring Available Options

As a small business owner, it is important to understand the various retirement plans available to you. By familiarizing yourself with these options, you can make informed decisions about which plan best suits your needs and the needs of your employees.

One retirement plan option for small business owners is the Simplified Employee Pension (SEP) IRA. This plan allows employers to contribute to traditional IRAs established for their employees. Contributions are made by the employer and are tax-deductible, providing potential tax advantages.

Another option is the Individual 401(k), also known as a solo 401(k). This plan is designed for self-employed individuals or business owners with no employees other than their spouse. It combines elements of a traditional 401(k) and a profit-sharing plan, allowing for higher contribution limits compared to other retirement plans.

The Simple IRA (Savings Incentive Match Plan for Employees) is another retirement savings option for small businesses. It is easy to set up and maintain, making it an attractive choice for employers who want to provide a retirement benefit without the administrative complexities of other plans.

For small business owners who want to contribute larger amounts towards their own retirement savings, a Defined Benefit Plan may be worth considering. This type of plan guarantees specific benefits at retirement based on factors such as salary history and years of service.

Lastly, Profit-Sharing Plans allow employers to make discretionary contributions based on company profits or performance metrics. These contributions can vary from year to year but provide flexibility in terms of how much is contributed annually.

Choosing the Right Retirement Plan for Small Business Success

Understanding these different retirement plans will help you choose the one that aligns with your financial goals and provides valuable benefits for both yourself and your employees. Consulting with a financial advisor or retirement specialist can further assist you in making an informed decision tailored specifically to your unique circumstances.

- Simplified Employee Pension (SEP) IRA:

A Simplified Employee Pension (SEP) IRA is a retirement savings plan that offers benefits to both employers and employees. It is designed for small business owners and self-employed individuals who want to provide retirement benefits for themselves and their employees.

One of the key benefits of a SEP IRA is its simplicity. Setting up and maintaining a SEP IRA is relatively easy compared to other retirement plans. There are no complex administrative requirements or ongoing fees, making it an attractive option for small businesses.

In terms of eligibility, both employers and employees can participate in a SEP IRA. Employers must meet certain criteria, such as having at least one employee who meets the eligibility requirements. Employees, on the other hand, must be at least 21 years old, have worked for the employer in at least three of the past five years, and have earned at least $600 in compensation during the year.

When it comes to contribution limits, SEP IRAs offer flexibility. Employers can contribute up to 25% of an eligible employee’s compensation or a maximum dollar amount determined each year by the IRS. However, contributions must be proportional for all eligible employees.

A Simplified Employee Pension (SEP) IRA provides several advantages including ease of setup and maintenance, eligibility for both employers and employees, as well as flexible contribution limits that make it an appealing choice for small businesses looking to provide retirement benefits.

- Individual 401(k):

The Individual 401(k) is a retirement savings plan designed specifically for self-employed individuals. It offers several advantages and considerations that make it an attractive option for those who work for themselves.

One of the key advantages of the Individual 401(k) is the higher contribution limits compared to other retirement plans. As of 2021, self-employed individuals can contribute up to $58,000 per year, or $64,500 if they are age 50 or older. This allows for significant tax-deferred savings and the potential for faster growth of retirement funds.

Another advantage is the flexibility it provides in terms of investment options. With an Individual 401(k), individuals have more control over their investment choices, allowing them to tailor their portfolio to their specific needs and risk tolerance.

Additionally, contributions to an Individual 401(k) may be tax-deductible, reducing taxable income and potentially lowering overall tax liability. This can provide additional financial benefits for self-employed individuals.

However, there are also considerations to keep in mind when considering an Individual 401(k). One important factor is the administrative responsibilities that come with managing a solo 401(k) plan. Self-employed individuals will need to ensure they comply with IRS regulations regarding contributions, reporting requirements, and any necessary paperwork.

It’s also worth noting that while the high contribution limits are advantageous for those who can afford to save more, they may not be feasible or necessary for everyone. Individuals should carefully evaluate their financial situation and goals before committing to a higher contribution amount.

The Individual 401(k) offers unique advantages such as higher contribution limits and investment flexibility for self-employed individuals. However, it’s important to consider both the benefits and responsibilities associated with this type of retirement plan before making a decision.

- Simple IRA:

A Simple IRA (Savings Incentive Match Plan for Employees) is a retirement plan option designed specifically for small businesses. It offers several features and benefits that make it an attractive choice for employers and their employees.

One of the key features of a Simple IRA is its simplicity. As the name suggests, it is easy to set up and maintain compared to other retirement plans. This makes it a viable option for small businesses that may not have the resources or expertise to manage complex retirement plans.

Another benefit of a Simple IRA is its flexibility. Employers have the option to match employee contributions, up to a certain percentage or dollar amount. This matching contribution can serve as an additional incentive for employees to participate in the plan and save for their retirement.

Contributions made by both employers and employees are tax-deductible, providing potential tax advantages for both parties. Additionally, earnings on investments within the Simple IRA grow tax-deferred until withdrawals are made during retirement.

Employees also benefit from the portability of a Simple IRA. If they change jobs, they can easily transfer their funds from one employer’s Simple IRA plan to another without incurring taxes or penalties.

Furthermore, participants in a Simple IRA have the ability to contribute more than what is allowed in traditional IRAs. In 2021, employees can contribute up to $13,500 (or $16,500 if age 50 or older) into their Simple IRA accounts.

Overall, a Simple IRA provides small businesses with an accessible and cost-effective way to offer retirement benefits to their employees while providing individuals with valuable tax advantages and long-term savings potential.

- Defined Benefit Plan:

A defined benefit plan, also known as a pension plan, is a retirement savings option that offers specific benefits to employees based on their salary and years of service. Unlike other retirement plans such as 401(k) or individual retirement accounts (IRAs), where the contributions are defined and the benefits may vary, defined benefit plans guarantee a specific amount of income for retirees.

Small business owners can greatly benefit from offering a defined benefit plan to their employees. Firstly, it helps attract and retain talented employees by providing them with a secure retirement income. This can be particularly appealing for individuals seeking long-term employment stability.

Additionally, small business owners who contribute to a defined benefit plan may also receive tax advantages. Contributions made towards the plan are generally tax-deductible, reducing the business’s taxable income. Furthermore, any earnings on investments within the plan grow tax-deferred until distributions are made during retirement.

Moreover, contributing to a defined benefit plan allows small business owners to save for their own retirement while simultaneously helping their employees do the same. By offering this type of plan, employers demonstrate their commitment to employee well-being and financial security.

It is important for small business owners considering implementing a defined benefit plan to consult with financial advisors or professionals specializing in retirement planning. They can provide guidance on setting up and managing these plans in accordance with legal requirements and best practices.

In summary, offering a defined benefit plan can be advantageous for small business owners as it helps attract talented employees, provides potential tax benefits, and demonstrates commitment to employee welfare. However, it is crucial to seek professional advice when establishing and managing these plans effectively.

- Profit-Sharing Plan:

Profit-sharing plans are a popular method for small businesses to provide financial incentives to their employees. This section will explore the concept of profit-sharing plans and how they work in the context of small businesses.

A profit-sharing plan is a type of employee benefit plan that allows eligible employees to receive a share of the company’s profits. The idea behind these plans is to align the interests of employees with the success and profitability of the business. By offering employees a stake in the company’s financial performance, it can motivate them to work harder and contribute towards its growth.

In a small business setting, profit-sharing plans can be particularly beneficial. They provide an opportunity for smaller companies with limited resources to reward their employees without incurring significant costs. Unlike traditional bonus programs, profit-sharing plans distribute a portion of the company’s profits among eligible employees based on predetermined criteria.

The specifics of how profit-sharing plans work can vary depending on the company’s objectives and structure. Typically, a formula or formulae are established to determine how much each employee will receive based on factors such as tenure, salary level, or individual performance metrics.

One key advantage of profit-sharing plans for small businesses is their flexibility. Employers have the ability to design these plans in ways that suit their unique needs and circumstances. They can choose whether contributions are made annually or more frequently, set vesting schedules for employee eligibility, and determine how profits are allocated among participants.

Implementing a profit-sharing plan requires careful consideration and communication with employees. It is crucial for employers to clearly explain how the plan works, what factors influence payouts, and what expectations should be set regarding performance goals or financial targets.

Overall, profit-sharing plans offer an attractive option for small businesses looking to incentivize their workforce while sharing in the success they help create. By aligning employee interests with company profitability through these programs, employers can foster motivation, loyalty, and ultimately drive growth within their organizations.

Choosing the right retirement plan for your small business is a crucial decision that can have long-term implications for both you as the business owner and your employees. There are several factors to consider when making this decision, including the tax advantages of different plans, employee participation requirements, and investment options.

Key Considerations in Choosing a Retirement Plan: Taxes, Employee Participation, and Investments

One important consideration is the tax advantages offered by various retirement plans. Different plans may provide different levels of tax benefits, such as deductions for employer contributions or tax-free growth of investments. Understanding these potential tax advantages can help you make an informed decision that maximizes your savings and minimizes your tax liability.

Another factor to consider is the level of employee participation required by different retirement plans. Some plans may require all eligible employees to participate, while others may allow for more flexibility in terms of who can join. It’s important to evaluate your workforce and determine what level of employee participation is feasible and beneficial for both you and your employees.

Additionally, it’s crucial to assess the investment options available within each retirement plan. Different plans may offer a range of investment choices, such as stocks, bonds, mutual funds, or target-date funds. Evaluating these options based on risk tolerance and potential returns can help ensure that you select a plan that aligns with your financial goals.

In conclusion, selecting the right retirement plan for your small business involves considering factors such as tax advantages, employee participation requirements, and investment options. By carefully evaluating these factors and seeking professional advice if needed, you can choose a plan that provides financial security for both yourself and your employees in their retirement years.

Securing Your Golden Years: Key Steps in Implementing and Managing a Retirement Plan

Implementing and managing a retirement plan is crucial for ensuring financial security in your golden years. It involves several key steps, including setting up your retirement plan, understanding the filing requirements, monitoring investment performance, and making adjustments when necessary.

To begin, setting up your retirement plan involves selecting the most suitable option based on your financial goals and circumstances. This may include options such as a 401(k), IRA, or pension plan. It’s important to carefully consider factors such as contribution limits, tax advantages, and employer matching programs.

Once your retirement plan is established, it’s essential to stay informed about the filing requirements associated with it. This may involve reporting contributions made to the plan and ensuring compliance with any applicable regulations or deadlines. Familiarize yourself with the necessary forms and documentation needed to fulfill these obligations.

Monitoring investment performance is another critical aspect of managing your retirement plan effectively. Regularly review the performance of your investments to ensure they align with your long-term goals. Consider factors such as asset allocation, diversification, and risk tolerance when assessing their suitability.

Making adjustments to your retirement plan when necessary is vital for adapting to changing circumstances or market conditions. Life events like job changes or significant financial milestones may require modifications to your savings strategy. Stay proactive by regularly reassessing your goals and consulting with financial advisors if needed.

By implementing and actively managing your chosen retirement plan, you can take control of securing a financially stable future. Stay informed about filing requirements, monitor investment performance diligently, and make adjustments as needed along the way for optimal results.

Small business owners face unique challenges when it comes to planning for retirement. With limited resources and competing financial priorities, it is crucial for them to understand the tax considerations and benefits associated with retirement plans. By taking advantage of these plans, small business owners can not only secure their own financial future but also enjoy potential tax advantages along the way.

We already explored the various tax considerations and benefits that small business owners should be aware of when considering retirement plans. We discussed different types of retirement plans available to them, such as Simplified Employee Pension (SEP) IRAs, Solo 401(k)s, and SIMPLE IRAs. Additionally, the specific tax advantages that these plans offer and how they can help small business owners reduce their taxable income while saving for retirement.

By understanding the tax implications and benefits of different retirement plans, small business owners can make informed decisions that align with their financial goals. Whether you are a sole proprietor or have a few employees under your belt, this section will provide valuable insights into maximizing your retirement savings while minimizing your tax liability as a small business owner.

Secure Your Future with Strategic Retirement Planning

Securing your future as a small business owner requires careful retirement planning. By implementing the right retirement plan, you can ensure financial security and set yourself up for success in the long run.

Retirement planning is essential for small business owners as it allows you to save and invest wisely, ensuring a comfortable retirement. With the right retirement plan in place, you can take advantage of tax benefits and maximize your savings potential.

Financial security is crucial for small business success. By planning for retirement, you can protect yourself and your loved ones from unforeseen circumstances or economic downturns. A well-thought-out retirement plan provides a safety net and peace of mind, allowing you to focus on growing your business without worrying about your future.

Remember that every small business owner’s situation is unique, so it’s important to consult with a financial advisor or retirement specialist who can help tailor a plan that aligns with your specific goals and circumstances.

In summary, investing time and resources into retirement planning as a small business owner is an investment in your own future. By securing your financial well-being through a comprehensive retirement plan, you can enjoy the rewards of your hard work while ensuring long-term success for both yourself and your business.

Also Read: Retirement Planning with Investments: A Comprehensive Guide to Secure Your Financial Future