Retirement investing and tax planning are two crucial aspects that go hand in hand when it comes to securing a comfortable future. As individuals, we all aspire to enjoy our golden years without financial stress, and careful consideration of these two areas can greatly contribute to achieving that goal.

Retirement investing involves setting aside funds for the future, ensuring a steady income stream even after we stop working. It allows us to build a nest egg that can support our lifestyle and provide for any unforeseen expenses that may arise during retirement. On the other hand, tax planning focuses on maximizing the benefits and minimizing the liabilities associated with taxes.

By understanding the importance of retirement investing and tax planning, we can effectively navigate through the complexities of financial management. Not only does retirement investing offer long-term security, but it also presents numerous tax advantages that can optimize our savings. Proper tax planning ensures that we make informed decisions about saving for retirement while taking advantage of available deductions, credits, and exemptions.

In this section, we will delve deeper into the significance of retirement investing and tax planning. We will explore strategies to save for retirement efficiently while maximizing potential tax benefits. By gaining knowledge in these areas, we empower ourselves to make informed choices regarding our financial well-being in later years.

Remember, preparing for retirement is not just about setting aside money; it’s about making smart investment decisions and leveraging tax advantages along the way. So let’s embark on this journey together as we unravel the intricacies of retirement investing and tax planning for a secure future ahead.

Table of Contents

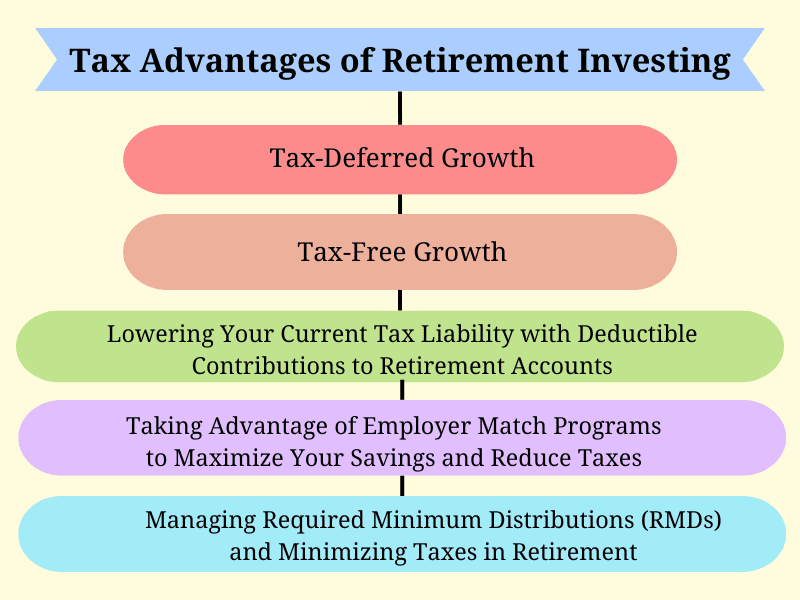

The Five Tax Advantages of Retirement Investing

- Tax-Deferred Growth: Exploring the Power of Traditional Retirement Accounts

When it comes to planning for retirement, traditional retirement accounts such as the traditional IRA and 401(k) play a significant role in helping individuals secure their financial future. One of the key advantages of these accounts is the concept of tax-deferred growth, which allows individuals to maximize their savings potential.

By making pre-tax contributions to these retirement accounts, individuals can effectively reduce their taxable income in the present. This means that they can defer paying taxes on the money they contribute until they withdraw it during retirement. As a result, their investments have the opportunity to grow and compound over time without being hindered by annual taxes.

The power of tax-deferred growth lies in its ability to harness compound interest. As earnings generated within the account are reinvested and continue to grow over time, individuals can benefit from exponential growth on their initial contributions. This compounding effect allows for accelerated wealth accumulation and can significantly impact an individual’s overall retirement savings.

Traditional retirement accounts offer a powerful tool for individuals seeking long-term financial security. Through tax-deferred growth and the benefits of compound interest, these accounts provide an effective strategy for maximizing savings potential and building a robust nest egg for retirement.

- Tax-Free Growth: The Benefits of Roth IRAs and Roth 401(k)s

When it comes to planning for retirement, considering tax implications is crucial. This is where Roth IRAs and Roth 401(k)s come into play, offering a unique advantage of tax-free growth.

Both Roth IRAs and Roth 401(k)s allow individuals to make after-tax contributions, which means that the money contributed has already been taxed. However, the real benefit lies in the fact that any earnings on these contributions grow tax-free over time.

The concept of tax-free growth is particularly appealing as it allows individuals to potentially accumulate substantial savings without worrying about future tax liabilities. This can be especially advantageous for those who anticipate being in a higher tax bracket during retirement.

Furthermore, qualified distributions from both Roth IRAs and Roth 401(k)s are also tax-free. This means that when it comes time to withdraw funds during retirement, individuals can do so without incurring additional taxes on their earnings.

Overall, the benefits of utilizing Roth IRAs and Roth 401(k)s are clear: the opportunity for tax-free growth and the ability to enjoy qualified distributions without facing additional taxes. These investment vehicles provide individuals with an effective strategy to maximize their savings potential while minimizing future tax burdens.

- Lowering Your Current Tax Liability with Deductible Contributions to Retirement Accounts

When it comes to managing our finances, finding ways to lower our tax liability is always a priority. One effective strategy that individuals can consider is making deductible contributions to retirement accounts. By taking advantage of the various options available, such as traditional IRA deductions and self-employed retirement plans like SEP-IRAs, individuals can not only save for their future but also potentially reduce their current tax burden.

Deductible contributions refer to the money that individuals contribute to their retirement accounts, which can be deducted from their taxable income. This means that the amount contributed is not subject to immediate taxation, providing a valuable opportunity for individuals to lower their overall tax liability.

Traditional IRA deductions are one common avenue for deductible contributions. Individuals who meet certain eligibility criteria can contribute funds into a traditional IRA and deduct those contributions from their taxable income. This allows them to potentially reduce the amount of taxes owed in the current year while simultaneously building a nest egg for retirement.

For self-employed individuals or small business owners, self-employed retirement plans such as SEP-IRAs offer another avenue for deductible contributions. These plans allow eligible participants to contribute a percentage of their income into a retirement account and deduct those contributions from their taxable income. This presents an attractive option for those looking to both save for retirement and lower their current tax liability.

By taking advantage of deductible contributions through traditional IRA deductions or self-employed retirement plans like SEP-IRAs, individuals can effectively manage their finances by reducing their taxable income and potentially lowering their overall tax burden. It is important, however, to consult with a financial advisor or tax professional who can provide guidance on eligibility requirements and contribution limits specific to each individual’s situation.

Lowering your current tax liability through deductible contributions to retirement accounts offers an advantageous strategy for long-term financial planning. Whether utilizing traditional IRA deductions or exploring self-employed retirement plans like SEP-IRAs, taking proactive steps towards maximizing these opportunities can lead not only to potential tax savings but also to a more secure financial future.

- Taking Advantage of Employer Match Programs to Maximize Your Savings and Reduce Taxes

When it comes to saving for retirement, taking advantage of employer match programs can be a game-changer. These programs, often found in 401(k) plans, offer a valuable opportunity to maximize your savings and reduce your taxes.

Employer match programs essentially involve your employer contributing a certain percentage of your salary to your retirement account. This means that for every dollar you contribute, your employer will match it up to a certain limit. By participating in these programs and maximizing the matching contributions, you can effectively double your savings without any additional effort on your part.

To make the most of employer match benefits, it’s important to understand the specifics of your company’s program. Take note of the matching formula and contribution limits. For example, if your employer offers a 50% match on contributions up to 6% of your salary, aim to contribute at least 6% to take full advantage of the program.

By maximizing employer match benefits, you not only boost your retirement savings but also enjoy immediate tax advantages. Contributions made through an employer match program are typically pre-tax dollars, meaning they are deducted from your taxable income for the year. This reduces the amount of income subject to taxes and can result in significant tax savings.

In summary, taking advantage of employer match programs is a smart financial move that allows you to turbocharge your retirement savings while reducing taxes. By understanding the specifics of these programs and contributing enough to meet the maximum matching limit, you can set yourself up for a more secure financial future.

- Managing Required Minimum Distributions (RMDs) and Minimizing Taxes in Retirement

As individuals approach retirement, managing Required Minimum Distributions (RMDs) becomes a crucial aspect of their financial planning. RMDs refer to the minimum amount that must be withdrawn from retirement accounts, such as IRAs and 401(k)s, once individuals reach a certain age. While RMDs are essential for ensuring a steady income during retirement, they can also result in significant tax implications if not managed strategically.

One of the key considerations when it comes to RMDs is minimizing taxes. Retirement accounts are typically tax-deferred, meaning that individuals have not paid taxes on the funds contributed to these accounts. However, when RMDs kick in, withdrawals become subject to income tax. Therefore, it becomes important for retirees to explore strategies that can help minimize their tax burden while still complying with the RMD requirements.

There are several strategies available to achieve this goal. One common approach is to consider Roth conversions before reaching the age of mandatory distributions. By converting traditional IRA funds into Roth IRAs, individuals can potentially reduce their future RMD amounts and associated taxes since qualified Roth distributions are generally tax-free.

Another strategy involves careful asset allocation within retirement accounts. By diversifying investments across different types of assets with varying growth rates and tax treatments, retirees may have more flexibility in managing their RMDs and potentially lowering their overall taxable income.

Additionally, charitable giving can be an effective way to minimize taxes on RMDs while supporting causes close to one’s heart. Qualified charitable distributions (QCDs) allow individuals who are at least 70½ years old to directly transfer up to $100,000 from an IRA account annually to eligible charities without counting it as taxable income.

It is important for retirees and those approaching retirement age to consult with financial advisors or tax professionals who specialize in retirement planning. These professionals can provide personalized guidance based on individual circumstances and help develop a comprehensive strategy for managing RMDs while minimizing tax implications. By staying informed and implementing effective strategies, individuals can navigate the complexities of RMDs and retirement taxation, ensuring a more financially secure future.

Leveraging the tax advantages of retirement investing is a crucial step towards securing a stable financial future. By taking advantage of tax-deferred or tax-free retirement accounts such as 401(k)s, IRAs, and Roth IRAs, individuals can maximize their savings and potentially reduce their overall tax burden.

Retirement investing offers several benefits beyond just saving for the future. It allows individuals to grow their investments over time through compounding interest and potential market gains. Additionally, contributions to certain retirement accounts may be tax-deductible, providing immediate tax benefits.

Furthermore, by strategically planning withdrawals during retirement, individuals can minimize their taxable income and potentially qualify for lower tax brackets. This can result in significant long-term savings and increased financial security during one’s golden years.

It is important to consult with a financial advisor or tax professional to understand the specific rules and regulations surrounding retirement investing and how it aligns with individual financial goals. By taking advantage of the available tax advantages offered by retirement investing vehicles, individuals can pave the way for a secure and prosperous financial future.

Also Read: Retirement Planning with Investments: A Comprehensive Guide to Secure Your Financial Future

1 thought on “The Tax Advantages of Retirement Investing: Maximizing Your Savings for the Future”