What are ETFs and How Do They Work?

In the world of investing, Exchange-Traded Funds (ETFs) have gained significant popularity in recent years. These investment vehicles offer a unique way for individuals to gain exposure to a diversified portfolio of assets, without the need for extensive research or active management. In this section, we will explore what Exchange-Traded Funds are and how they work.

An ETF is essentially a type of investment fund that trades on stock exchanges, just like individual stocks. It is designed to track the performance of a specific index, such as the S&P 500 or the Nasdaq-100. This makes it different from traditional mutual funds, which are typically actively managed.

One of the key advantages of Exchange-Traded Funds is their ability to provide investors with access to a wide range of asset classes and sectors. By investing in an ETF that tracks a particular index, investors can gain exposure to multiple companies within that index, spreading their risk across various holdings.

Exchange-Traded Funds also offer flexibility in terms of trading. Unlike mutual funds that are priced at the end of each trading day, ETFs can be bought and sold throughout market hours at prices that fluctuate in real-time. This allows investors to take advantage of intraday price movements and adjust their positions accordingly.

Additionally, Exchange-Traded Funds are known for their cost-efficiency compared to other investment options. As passive investment vehicles, they generally have lower expense ratios compared to actively managed funds since they aim to replicate rather than outperform an index.

In summary, Exchange-Traded Funds provide investors with an opportunity for passive investing by tracking specific indices or asset classes. They offer diversification benefits and flexibility in trading while being cost-effective alternatives to traditional mutual funds. In the following sections, we will delve deeper into how Exchange-Traded Funds work and explore different types and use cases within this popular investment instrument.

Table of Contents

The Benefits of Investing in ETFs: Why They are a Popular Choice

Investing in ETFs (Exchange-Traded Funds) has become a popular choice for many investors due to the numerous benefits they offer. One of the key advantages of investing in ETFs is diversification. ETFs typically hold a basket of different securities, such as stocks, bonds, or commodities, which helps spread risk across various assets. This diversification can help reduce the impact of any single investment’s performance on your overall portfolio.

Another benefit of investing in Exchange-Traded Funds is their low fees. Compared to actively managed mutual funds, ETFs generally have lower expense ratios. This is because ETFs are passively managed and aim to replicate the performance of a specific index rather than relying on active fund managers.

Liquidity is another advantage offered by Exchange-Traded Funds. Being listed on stock exchanges, ETF shares can be bought and sold throughout the trading day at market prices. This provides investors with flexibility and ease when it comes to entering or exiting their positions.

Transparency is also a notable benefit of investing in ETFs. Unlike some other investment vehicles, such as mutual funds, which may disclose their holdings only periodically, most ETFs provide daily transparency regarding their holdings. This allows investors to have a clear understanding of what assets they own within the fund.

Overall, the benefits of investing in ETFs make them an attractive choice for many investors seeking diversification, low fees, liquidity, and transparency in their investment portfolios.

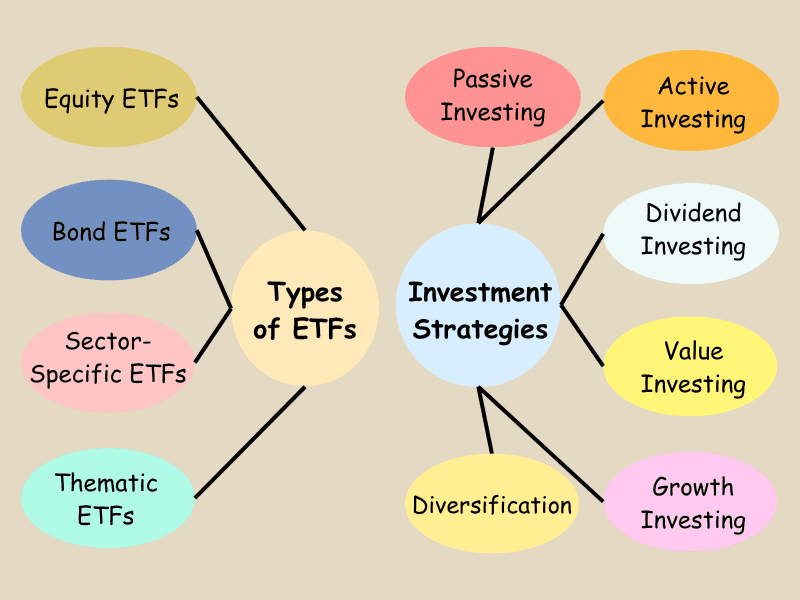

Types of ETFs and Their Investment Strategies

Exchange-Traded Funds (ETFs) have gained significant popularity among investors due to their flexibility and diversification benefits. There are various types of ETFs available in the market, each with its own unique investment strategy.

- Equity ETFs: Equity ETFs are designed to track a specific stock market index, such as the S&P 500 or Nasdaq 100. These funds invest in a diversified portfolio of stocks, allowing investors to gain exposure to a broad range of companies within a particular market segment or region.

- Bond ETFs: Bond ETFs provide investors with exposure to fixed-income securities such as government bonds, corporate bonds, or municipal bonds. These funds aim to replicate the performance of a bond index and offer diversification within the fixed-income asset class.

- Sector-Specific ETFs: Sector-specific ETFs focus on specific sectors of the economy, such as technology, healthcare, energy, or financial services. These funds allow investors to target their investments in industries they believe will outperform the broader market.

- Thematic ETFs: Thematic ETFs invest in companies that align with specific themes or trends, such as clean energy, artificial intelligence, cybersecurity, or robotics. These funds offer exposure to sectors that are expected to experience significant growth due to societal shifts or technological advancements.

It’s important for investors to carefully consider their investment objectives and risk tolerance before investing in any type of ETF. Additionally, conducting thorough research on the underlying holdings and performance history can help make informed investment decisions when selecting from different types of Exchange-Traded Funds available in the market.

Choosing the Right ETF for Your Investment Goals: Factors to Consider

Choosing the right ETF (Exchange-Traded Fund) for your investment goals requires careful consideration of several factors. These factors include the expense ratio, tracking error, asset class exposure, and tax efficiency.

The expense ratio is an important factor to consider as it directly impacts your investment returns. It represents the annual fee charged by the ETF provider for managing the fund. A lower expense ratio means more of your investment goes towards generating returns.

Tracking error measures how closely an ETF tracks its underlying index or benchmark. A lower tracking error indicates that the ETF closely mirrors its intended performance, which is crucial for investors who want their investments to closely align with a specific index.

Asset class exposure refers to the types of assets held within an ETF. Different Exchange-Traded Funds provide exposure to various asset classes such as stocks, bonds, commodities, or real estate. It is essential to assess whether an ETF’s asset class exposure aligns with your investment goals and risk tolerance.

Tax efficiency is another crucial consideration when choosing an ETF. Some ETFs are structured in a way that minimizes taxable events such as capital gains distributions. This can be advantageous for investors seeking long-term growth without triggering unnecessary tax liabilities.

By carefully evaluating these factors – expense ratio, tracking error, asset class exposure, and tax efficiency – you can make a more informed decision when selecting the right ETF that aligns with your investment goals and risk preferences.

The Role of ETFs in Portfolio Construction: How to Use Them Effectively

When it comes to portfolio construction, Exchange-Traded Funds (ETFs) play a significant role in providing investors with diversified exposure to various asset classes. ETFs have gained popularity due to their flexibility, transparency, and cost-effectiveness. In this section, we will explore the role of ETFs in portfolio construction and discuss how they can be used effectively.

One key advantage of using ETFs in portfolio construction is the ability to implement different asset allocation strategies. These strategies involve allocating investments across various asset classes such as stocks, bonds, commodities, or real estate. With the wide range of ETF options available, investors can easily access these asset classes and create a well-diversified portfolio.

Furthermore, ETFs offer an efficient way to rebalance portfolios. Rebalancing involves adjusting the allocation of assets within a portfolio to maintain desired risk and return characteristics. By using ETFs, investors can easily reallocate their investments without incurring excessive trading costs or tax implications.

To use ETFs effectively in portfolio construction and rebalancing, it is important for investors to have a clear understanding of their investment goals and risk tolerance. Additionally, conducting thorough research on different ETF options and considering factors such as expense ratios, tracking error, liquidity, and underlying holdings is crucial for making informed investment decisions.

Overall, incorporating ETFs into portfolio construction provides investors with diversification benefits across different asset classes while offering flexibility in implementing various asset allocation strategies. Additionally, utilizing these funds for rebalancing purposes can help maintain desired risk levels over time.

Risks and Limitations of Investing in ETFs: What You Need to Know

Investing in ETFs (Exchange-Traded Funds) can be a great way to diversify your portfolio and gain exposure to a wide range of assets. However, it’s important to be aware of the risks and limitations associated with these investment vehicles.

One risk to consider is the magnitude risk. This refers to the potential for an ETF’s value to fluctuate significantly due to market conditions or underlying asset performance. While diversification can help mitigate this risk, it’s important to understand that there is still the potential for losses.

Liquidity risk is another factor to keep in mind when investing in ETFs. This refers to the ease at which an investor can buy or sell shares of an ETF without impacting its market price. In some cases, certain ETFs may have lower trading volumes or less liquid underlying assets, which could make it more difficult to execute trades at desired prices.

Tracking error risk is also worth considering. This refers to the possibility that an ETF may not perfectly replicate the performance of its underlying index or asset class due to various factors such as fees, transaction costs, and imperfect tracking methodologies. It’s important for investors to evaluate an ETF’s historical tracking error and understand how it may impact their investment returns.

While investing in ETFs can offer many benefits, including diversification and cost-effectiveness, it’s crucial for investors to carefully assess these risks and limitations before making any investment decisions. Consulting with a financial advisor or conducting thorough research can help investors make informed choices that align with their investment goals and risk tolerance levels.

Trends and Innovations in the World of ETF Investing

In recent years, the world of ETF (Exchange-Traded Fund) investing has witnessed several trends and innovations that have reshaped the landscape. One prominent trend is the rise of sustainable investing, with a particular focus on ESG (Environmental, Social, and Governance) factors. Investors are increasingly seeking out ETFs that align with their values and prioritize companies with strong sustainability practices.

Another notable trend is the emergence of smart beta strategies within ETFs. Smart beta refers to investment strategies that aim to outperform traditional market-cap weighted indices by selecting stocks based on specific factors such as low volatility, value, or momentum. These strategies provide investors with an alternative to traditional passive indexing while still maintaining the benefits of diversification and cost-effectiveness associated with ETFs.

Furthermore, there has been an increasing interest in active management within the structure of an index-tracking fund. This allows for greater flexibility in portfolio construction and enables fund managers to make tactical adjustments based on market conditions or specific investment themes. By combining active management techniques with the efficiency and transparency of ETFs, investors can benefit from both active decision-making and lower costs compared to traditional mutual funds.

Overall, these trends and innovations in ETF investing reflect a growing demand for more customized investment solutions that align with individual preferences and objectives. As technology continues to advance, we can expect further advancements in this space as investors seek innovative ways to navigate the ever-evolving financial markets.

Leveraging the Power of Exchange-Traded Funds for Long-Term Investment Success

Leveraging the power of Exchange-Traded Funds (ETFs) can be a game-changer for long-term investment success. ETFs offer numerous benefits that make them an attractive option for investors.

One of the key advantages of ETFs is their ability to provide diversification. By investing in an ETF that tracks a specific index or sector, investors can gain exposure to a wide range of assets without having to purchase each individual security. This helps spread risk and reduces the impact of any single investment on the overall portfolio.

Additionally, ETFs are known for their low-cost structure. Compared to actively managed funds, which typically have higher expense ratios due to active trading and management fees, ETFs generally have lower expense ratios. This makes them an appealing choice for investors looking to minimize costs and maximize returns over the long term.

Furthermore, ETFs offer the benefit of passive investing. Rather than relying on active fund managers to make investment decisions, ETFs aim to replicate the performance of a specific index or asset class. This approach eliminates human bias and emotions from the decision-making process and allows investors to benefit from broad market trends.

By leveraging these advantages, investors can position themselves for long-term investment success with ETFs. However, it is important for individuals to conduct thorough research and consider their own financial goals and risk tolerance before making any investment decisions.

In conclusion, Exchange-Traded Funds provide opportunities for diversification, low-cost investing, and passive strategies that can contribute significantly to long-term investment success. By incorporating these powerful tools into their portfolios intelligently and with careful consideration of individual circumstances and goals, investors can enhance their chances of achieving their financial objectives over time.

Also Read: An In-Depth Introduction to Investing for Success: Unlocking Financial Growth

2 thoughts on “Understanding ETFs: A Comprehensive Guide to Exchange-Traded Funds”