Planning for retirement is akin to charting a course toward financial security, and Individual Retirement Accounts (IRAs) stand as versatile vessels on this voyage. In this beginner’s guide, we’ll embark on a journey to demystify the world of IRA investment choices, shedding light on the diverse options available to individuals keen on maximizing their retirement savings.

Understanding IRA investment choices is crucial, as these accounts not only provide a tax-advantaged haven but also serve as powerful tools for wealth accumulation. Whether you’re new to the realm of retirement planning or looking to optimize your existing strategies, this guide aims to empower you with knowledge about the various paths you can take within the realm of IRAs.

Table of Contents

What is the importance of maximizing retirement savings through IRAs

Maximizing retirement savings through Individual Retirement Accounts (IRAs) holds paramount importance for individuals seeking financial security in their golden years. Several key factors underscore the significance of making the most of these tax-advantaged accounts:

- Tax Advantages:

IRAs offer tax benefits that can significantly enhance your retirement savings. Contributions to traditional IRAs are often tax-deductible, providing an immediate reduction in taxable income. Roth IRAs, while funded with after-tax dollars, offer tax-free withdrawals in retirement. These tax advantages can optimize the growth of your retirement nest egg over time. - Compound Growth:

Time is a critical factor in wealth accumulation, and IRAs allow for the power of compound growth. The earnings on your IRA investments have the potential to grow tax-deferred or tax-free, depending on the type of IRA. This compounding effect can significantly boost the overall value of your retirement savings, especially when contributions are made consistently over an extended period. - Diverse Investment Options:

IRAs provide a broad spectrum of investment choices beyond traditional savings accounts. From stocks and bonds to real estate, precious metals, and more, the diversified investment options within IRAs enable individuals to tailor their portfolios according to their risk tolerance, financial goals, and market conditions. This flexibility can contribute to a more resilient and adaptable retirement strategy. - Retirement Income Stream:

IRAs serve as a vehicle to accumulate wealth during your working years, but they also play a crucial role in generating retirement income. As you approach retirement age, you can begin withdrawing funds from your IRA to cover living expenses. The structured distribution of funds allows for a steady income stream, supplementing other sources such as Social Security or pensions. - Estate Planning and Legacy:

IRAs provide opportunities for strategic estate planning. Designating beneficiaries and understanding the rules surrounding inherited IRAs can facilitate the smooth transfer of assets to your heirs. This can be a valuable component of your legacy planning, ensuring that your hard-earned savings continue to benefit your loved ones. - Financial Independence:

By maximizing contributions to your IRA, you are taking proactive steps toward achieving financial independence in retirement. Depending less on social welfare programs and employer-sponsored plans, such as 401(k)s, IRAs empower individuals to have more control over their financial destinies, fostering a sense of autonomy and security.

The importance of maximizing retirement savings through IRAs lies in the unique combination of tax advantages, investment flexibility, and long-term growth potential. By harnessing these benefits, individuals can create a robust financial foundation that not only supports a comfortable retirement lifestyle but also provides peace of mind in the face of economic uncertainties.

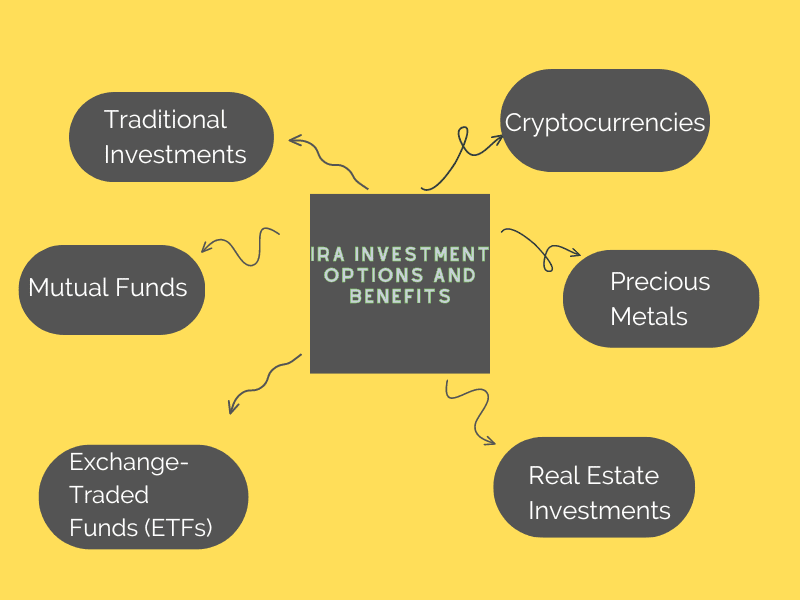

IRA investment options and benefits

Individual Retirement Accounts (IRAs) offer a versatile array of investment options and compelling benefits, making them instrumental tools for building a secure financial future. Understanding the overview of IRA investment options and their associated advantages is key to making informed decisions tailored to your retirement goals.

Investment Options:

- Traditional Investments:

Traditional IRAs provide a familiar landscape for conventional investments such as stocks and bonds. These assets, known for their liquidity and potential for capital appreciation, form the core of many retirement portfolios. - Mutual Funds:

Mutual funds pool funds from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer a hands-off approach to diversification, making them suitable for those seeking professional management of their investments. - Exchange-Traded Funds (ETFs):

ETFs combine elements of stocks and mutual funds, trading on stock exchanges like individual stocks. They offer diversification, low expense ratios, and the flexibility of trading throughout the day, making them popular choices within IRA portfolios. - Real Estate Investments:

Some IRAs allow for investments in real estate, providing an opportunity to diversify beyond traditional securities. Real estate can offer potential rental income and capital appreciation, adding a tangible asset to your retirement portfolio. - Precious Metals:

Precious metals, such as gold and silver, have gained popularity as alternative investments within IRAs. They are seen as a hedge against inflation and market volatility, offering diversification and stability to a retirement portfolio. - Cryptocurrencies:

In recent years, the inclusion of cryptocurrencies like Bitcoin and Ethereum in IRAs has emerged. While considered more speculative, cryptocurrencies can add a dynamic and potentially high-reward element to a well-diversified portfolio.

What are the benefits of IRA investment options?

Flexibility in Investment Choices:

- Traditional IRA: Offers a wide range of investment options, including stocks, bonds, mutual funds, and other traditional investment vehicles.

- Roth IRA: Provides flexibility for unconventional investments like real estate, cryptocurrencies, and other non-traditional assets.

Control Over Investments:

- Self-Directed IRA: Allows for greater control over investment decisions, enabling you to choose specific assets like real estate, precious metals, and private equity. This level of control can align your investments with your unique financial goals.

Retirement Income Stream:

- As you reach retirement age, IRAs provide a source of income. You can structure withdrawals to meet your specific needs, supplementing other sources of retirement income.

Portability and Accessibility:

- IRAs are not tied to employment, offering portability if you change jobs. This ensures that your retirement savings remain under your control.

- Some IRAs, like Roth IRAs, allow penalty-free withdrawals of contributions at any time, providing a degree of flexibility in emergencies.

Potential for Tax-Free Withdrawals:

- Qualified distributions from a Roth IRA, including earnings, are tax-free. This can be advantageous during retirement when having tax-free income can enhance your financial situation.

Risk Management:

- Through a diversified investment strategy, IRAs help manage risk by spreading investments across different asset classes. This can mitigate the impact of poor performance in any single investment.

Incentives for Catch-Up Contributions:

- Individuals aged 50 and older can make additional “catch-up” contributions to their IRAs, allowing them to accelerate their savings in the years leading up to retirement.

- IRA investment options showcases a spectrum of choices that cater to different investment philosophies and risk appetites. The associated benefits, from tax advantages to flexibility and estate planning opportunities, underscore the importance of IRAs as indispensable tools for building and safeguarding wealth in preparation for retirement.

Traditional IRA Investments

Definition and Basic of Traditional IRAs:

A Traditional Individual Retirement Account (IRA) is a retirement savings tool that allows individuals to contribute pre-tax dollars, providing a tax-deferred growth environment. Essentially, when you contribute to a traditional IRA, you may deduct the contribution amount from your taxable income for that year, potentially lowering your overall tax bill.

The investments within the IRA grow tax-deferred until you start withdrawing funds in retirement. Traditional IRAs are especially beneficial for those looking to reduce current tax liabilities while planning for a financially secure retirement.

Common Investment Choices for Traditional IRAs:

Traditional IRAs offer a menu of investment options to help individuals tailor their portfolios according to their financial goals and risk tolerance. Three common choices within traditional IRAs are:

Stocks and Bonds:

Investing in individual stocks or bonds provides the opportunity for capital appreciation and interest income. Stocks represent ownership in companies, while bonds are debt instruments that pay periodic interest. These traditional securities offer a range of risk and return profiles, allowing investors to diversify their holdings.

Mutual Funds:

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They provide instant diversification, professional management, and are suitable for investors seeking a hands-off approach to managing their investments.

Exchange-Traded Funds (ETFs):

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification, often lower expense ratios, and the flexibility of trading throughout the day. ETFs are a popular choice for those who value liquidity and want exposure to various market sectors.

Advantages and Considerations for Traditional IRA Investments:

Advantages:

Investing in a traditional IRA comes with notable advantages. Firstly, contributions are often tax-deductible, providing an immediate reduction in taxable income.

Secondly, the earnings on investments grow tax-deferred until withdrawals in retirement, allowing for compounded growth. This tax advantage can significantly enhance the overall value of your retirement savings over time. Additionally, traditional IRA investments offer flexibility, allowing individuals to choose from a variety of asset classes.

Considerations:

While traditional IRAs offer compelling advantages, there are essential considerations. One key consideration is that withdrawals in retirement are taxed as ordinary income. It’s crucial to plan for potential tax implications when deciding on the amount to contribute.

Additionally, traditional IRAs have required minimum distributions (RMDs) starting at age 72, which means you must begin withdrawing a certain amount annually. Understanding these considerations helps individuals make informed decisions aligned with their unique financial situations and retirement goals.

Roth IRA Investment Choices

Definition and Basic of Roth IRAs:

A Roth Individual Retirement Account (IRA) is a unique retirement savings vehicle known for its tax advantages. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you don’t get an immediate tax deduction. However, the real magic happens when you retire.

Qualified withdrawals from a Roth IRA, including both contributions and earnings, are entirely tax-free. This makes Roth IRAs a powerful tool for those anticipating higher tax brackets in retirement or seeking tax-free income. Moreover, Roth IRAs do not mandate required minimum distributions (RMDs), providing flexibility in managing your withdrawals during retirement.

Different Investment Options Available for Roth IRAs:

Roth IRAs offer a diverse range of investment options, allowing investors to align their portfolios with their risk tolerance and financial objectives. Here are three popular choices:

Real Estate Investments:

Roth IRAs permit investment in real estate, offering the potential for rental income and property appreciation. This option allows individuals to diversify their portfolios beyond traditional securities, adding a tangible asset to their retirement holdings.

Peer-to-Peer Lending:

Investing in peer-to-peer lending platforms through a Roth IRA involves lending money directly to individuals or small businesses. This option can provide a steady stream of interest income, and the risk and return profiles can be tailored based on the borrower’s creditworthiness.

Cryptocurrencies:

Roth IRAs also allow investment in cryptocurrencies like Bitcoin and Ethereum. While considered more speculative, investing in cryptocurrencies within a Roth IRA offers the potential for tax-free growth, making it an attractive option for those intrigued by the digital asset space.

Pros and Cons of Each Roth IRA Investment Choice:

1. Real Estate Investments:

Pros: Real estate can provide a source of passive income and potential property appreciation, diversifying your portfolio. Additionally, rental income and capital gains within a Roth IRA are tax-free.

Cons: Real estate investments can be illiquid, and property management may require active involvement. Market fluctuations can impact property values.

2. Peer-to-Peer Lending:

Pros: Peer-to-peer lending offers the potential for regular interest income, and the risk can be managed by selecting borrowers based on creditworthiness. The interest earned is tax-free within a Roth IRA.

Cons: There is a risk of borrower default, and the returns may vary. The lending platform’s fees can also impact overall returns.

3. Cryptocurrencies:

Pros: Investing in cryptocurrencies within a Roth IRA allows for potential tax-free growth. It adds a high-risk, high-reward element to the portfolio and can serve as a hedge against traditional market movements.

Cons: Cryptocurrencies are highly volatile, and their values can be unpredictable. Regulatory uncertainties and security concerns are additional factors to consider.

Understanding the pros and cons of each Roth IRA investment choice is crucial for making informed decisions that align with your risk tolerance and financial goals. It’s recommended to carefully evaluate these options and, if needed, seek advice from financial professionals to ensure a well-balanced and suitable Roth IRA investment strategy.

Self-Directed IRA Investments

A Self-Directed Individual Retirement Account (IRA) stands apart from traditional and Roth IRAs by offering a higher degree of autonomy in investment choices. With a self-directed IRA, individuals have the power to invest in a broad range of assets beyond the conventional options provided by other IRA types.

This includes real estate, precious metals, private equity, and more. The “self-directed” aspect means that the account owner, rather than a custodian, has the authority to make investment decisions, providing a unique level of control and diversity in crafting a personalized retirement portfolio.

Various Investment Opportunities Within Self-Directed IRAs:

Precious Metals in IRAs (Keywords: Precious Metals in IRAs):

Self-directed IRAs offer the opportunity to include precious metals, such as gold and silver, in your investment portfolio. This option is particularly appealing for those looking to diversify and potentially hedge against economic uncertainties. The inclusion of precious metals adds a tangible asset with intrinsic value to the overall investment strategy.

Real Estate Investments:

Real estate is a prominent investment avenue within self-directed IRAs. Account holders can invest in residential or commercial properties, providing opportunities for rental income, property appreciation, and portfolio diversification. This flexibility allows individuals to leverage the stability and potential returns associated with real estate.

Private Equity Investments:

Self-directed IRAs also permit investments in private equity, which includes ownership stakes in private companies. This option offers the potential for higher returns, but it comes with increased risk due to the limited liquidity of private equity investments. Nonetheless, for those seeking ventures beyond traditional markets, private equity can be an attractive addition to a self-directed IRA.

The Benefits and Risks Associated With Self-Directed IRA Investments:

Benefits:

Self-directed IRAs offer several advantages. Firstly, the broad array of investment choices allows for greater diversification, potentially enhancing the resilience of the portfolio against market fluctuations.

Secondly, the ability to invest in alternative assets like precious metals, real estate, and private equity provides opportunities for potentially higher returns. Additionally, the hands-on approach empowers individuals to align their investments with personal values and market insights.

Risks:

While self-directed IRAs offer unique benefits, they come with inherent risks. One significant risk is the potential lack of liquidity, especially with investments like real estate and private equity. These assets may take time to sell, impacting the account holder’s ability to access funds quickly.

The complexity of certain investments, coupled with the need for thorough due diligence, requires a keen understanding of the chosen assets. Additionally, the absence of regulatory oversight for specific alternative investments within self-directed IRAs necessitates a cautious and informed approach.

In summary, self-directed IRAs present a distinctive approach to retirement investing, offering unparalleled control and a diverse range of investment options. However, individuals must carefully weigh the benefits against the risks, considering their financial goals, risk tolerance, and commitment to due diligence when navigating the self-directed IRA landscape.

The Benefits of Including Precious Metals in IRAs

The Precious Metals as an Investment Option. Precious metals have long captured the imagination of investors as timeless symbols of wealth and stability. These metals, including gold, silver, platinum, and palladium, hold intrinsic value and have been sought after for their rarity and enduring allure.

In the context of Individual Retirement Accounts (IRAs), the inclusion of precious metals offers a unique avenue for diversification, allowing investors to move beyond traditional securities and explore tangible assets that have historically been recognized as stores of value.

Reasons to Consider Investing in Precious Metals Within an IRA. Investing in precious metals within an IRA is a strategic move that aligns with various financial objectives. Firstly, precious metals, particularly gold and silver, have served as effective hedges against inflation and market volatility. Their value often moves inversely to traditional financial assets, providing a potential buffer during economic uncertainties.

Secondly, these metals have demonstrated resilience over time, preserving wealth across generations. By incorporating precious metals into your IRA, you introduce a layer of stability to your portfolio, enhancing its ability to weather changing economic conditions.

The Different Types of Precious Metals Suitable for IRAs. When considering precious metals for your IRA, it’s essential to be aware of the various types that can be included. The following are commonly suitable for IRAs:

- Gold: Renowned for its enduring value, gold is a staple in precious metal portfolios. Its stability and resistance to inflation make it a favored choice for investors seeking wealth preservation.

- Silver: Often considered the “poor man’s gold,” silver is valued for its industrial uses and affordability. It offers both diversity and a potential hedge against economic fluctuations.

- Platinum: With a higher rarity than gold and silver, platinum is sought after for its dual role as a precious metal and an industrial catalyst. Its inclusion in IRAs adds an additional layer of diversification.

- Palladium: This lesser-known precious metal has gained prominence, particularly in the automotive industry. Palladium’s scarcity and demand make it an intriguing option for investors looking to broaden their IRA holdings.

Understanding the distinctions between these precious metals allows investors to tailor their portfolios to their specific preferences and risk profiles within the framework of their IRAs. Including a mix of these metals can contribute to a well-balanced and resilient retirement investment strategy.

How to Invest in Precious Metals within an IRA

Investing in precious metals within an Individual Retirement Account (IRA) involves a straightforward process with specific requirements. First, it’s essential to have a self-directed IRA, as traditional and Roth IRAs may not allow for alternative investments like precious metals.

Once you’ve established a self-directed IRA, the process typically involves selecting a reputable custodian or trustee, which specializes in handling alternative assets.

Additionally, the IRS has strict guidelines on the types of precious metals allowed in an IRA, with approved options typically including gold, silver, platinum, and palladium. Compliance with these regulations ensures that your investment aligns with IRS standards for precious metals held within the tax-advantaged structure of an IRA.

Selecting a reputable custodian or trustee is a critical step in the process of investing in precious metals within an IRA. These financial institutions specialize in administering self-directed IRAs and have experience handling alternative assets like precious metals.

When choosing a custodian, it’s crucial to consider factors such as reputation, fees, and the range of services offered. Reputable custodians provide secure storage options for physical precious metals and facilitate the necessary record-keeping for IRS compliance.

Conducting thorough research and, if possible, seeking recommendations can help ensure that you partner with a custodian who aligns with your investment goals and values.

Transferring or rolling over funds into a precious metals IRA involves a systematic process to ensure compliance and a seamless transition.

The first step is to open a self-directed IRA account with the chosen custodian. Once the account is established, the next step is to fund it by either transferring funds from an existing IRA or rolling over funds from a 401(k) or another eligible retirement account.

The custodian will guide you through the paperwork, ensuring that the transaction adheres to IRS regulations. Once the funds are in the self-directed IRA, you can work with the custodian to select the specific precious metals for investment.

The custodian will handle the purchase and secure storage of the metals, maintaining the necessary documentation to meet IRS requirements. Regular communication with the custodian ensures that your precious metals IRA remains in compliance with tax regulations and contributes to your long-term financial goals.

Considerations and Risks of Precious Metals in IRAs

Investing in precious metals within an Individual Retirement Account (IRA) presents potential benefits, notably as a strategic hedge against inflation and market volatility. Precious metals, such as gold and silver, have historically demonstrated an inverse relationship with inflation.

When traditional currencies lose value due to rising prices, precious metals often retain or increase their worth, providing a safeguard for investors.

Additionally, during times of market turbulence and economic uncertainty, precious metals can act as a stabilizing force in a diversified portfolio. The inherent value and global acceptance of these metals make them a tangible asset that can help mitigate the impact of economic fluctuations, contributing to a more resilient investment strategy within the tax-advantaged structure of an IRA.

While there are potential benefits, it’s crucial to acknowledge the challenges and risks associated with investing in precious metals.

One significant challenge is the volatility inherent in the prices of gold, silver, and other metals. Their values can experience sharp fluctuations based on various factors, including economic data, geopolitical events, and market sentiment.

Additionally, precious metals do not generate income like dividend-paying stocks or interest-bearing bonds, which can impact overall portfolio returns. Furthermore, the lack of regular income may make it challenging for some investors to incorporate precious metals into an income-focused retirement strategy.

Understanding and carefully managing these risks are essential to making informed decisions about the role of precious metals in an IRA.

To navigate the considerations and risks associated with precious metals in IRAs, proper diversification and balancing within a precious metals portfolio are crucial. Diversification involves spreading investments across different asset classes to reduce overall risk.

While precious metals can serve as a valuable diversification tool, it’s essential not to overallocate. Striking the right balance by combining precious metals with other asset classes, such as stocks, bonds, and real estate, can enhance the stability of the overall portfolio.

Regular monitoring and rebalancing are key to maintaining the desired allocation and adapting to changing market conditions. By approaching precious metals as part of a well-diversified strategy, investors can harness their potential benefits while managing the inherent challenges and risks, optimizing their IRA for long-term financial success.

Recap of the Various IRA Investment Choices Discussed:

Let’s take a moment to recap the diverse investment choices explored for Individual Retirement Accounts (IRAs). Within the landscape of retirement planning, individuals have the flexibility to choose from Traditional IRAs, where stocks, bonds, mutual funds, and ETFs form the foundation; Roth IRAs, which open doors to real estate, peer-to-peer lending, and cryptocurrencies; and Self-Directed IRAs, offering unique autonomy with options like precious metals, real estate, and private equity. Each pathway presents its own set of opportunities and considerations, empowering individuals to craft a customized portfolio aligned with their financial goals and risk tolerance.

Traditional IRAs: Stocks, bonds, mutual funds, and ETFs.

Roth IRAs: Real estate, peer-to-peer lending, cryptocurrencies.

Self-Directed IRAs: Precious metals, real estate, private equity.

Encouragement to Seek Professional Advice Before Making Investment Decisions:

As we navigate the intricate landscape of IRA investment choices, it’s paramount to emphasize the importance of seeking professional advice. Financial advisors bring valuable expertise to the table, helping individuals make informed decisions tailored to their unique financial circumstances. The intricacies of tax implications, risk assessments, and long-term planning require careful consideration. Professional guidance ensures that your chosen investment strategy aligns seamlessly with your retirement goals, providing a solid foundation for financial well-being in the years to come.

The potential for maximizing retirement savings lies in the thoughtful selection of suitable IRA investment options. The journey through Traditional, Roth, and Self-Directed IRAs has unveiled a spectrum of choices, from conventional securities to alternative assets. By understanding the benefits, risks, and considerations associated with each investment avenue, individuals can tailor their IRA portfolios to optimize growth and resilience. As we envision the future, the power to secure a comfortable retirement rests in the hands of those who navigate these options with prudence, seeking a balance that aligns with their financial aspirations. May your IRA investments pave the way for a fulfilling retirement journey, marked by financial security and peace of mind.

Also Read: How to Start Investing: A Comprehensive Guide for Beginners to Build Wealth In 2023

4 thoughts on “IRA Investment Choices: A Comprehensive Guide”