Savings accounts play a crucial role in personal finance and are an essential tool for individuals seeking financial security. In this section, we will explore what savings accounts are and why they matter in today’s world.

A savings account is a type of bank account specifically designed to help individuals save money for future needs or goals. It offers a safe and secure place to store funds while earning interest on the deposited amount. Unlike checking accounts that are primarily used for daily transactions, savings accounts encourage individuals to set aside a portion of their income for long-term saving purposes.

The importance of saving money cannot be overstated. It provides a safety net during unexpected emergencies, such as medical expenses or sudden job loss. Saving money also allows individuals to achieve their financial goals, whether it’s buying a house, starting a business, or planning for retirement.

Financial security is another key reason why savings accounts matter. By consistently contributing to a savings account, individuals can build up an emergency fund that provides peace of mind and acts as a buffer against unexpected financial hardships. Additionally, having savings can help reduce reliance on credit cards or loans in times of need, thereby avoiding high-interest debt.

In summary, savings accounts serve as an effective tool for managing personal finances and achieving long-term financial stability. They offer individuals the opportunity to save money systematically while earning interest over time. By understanding the importance of saving money and utilizing savings accounts wisely, individuals can pave the way towards greater financial security and achieve their desired financial goals.

Table of Contents

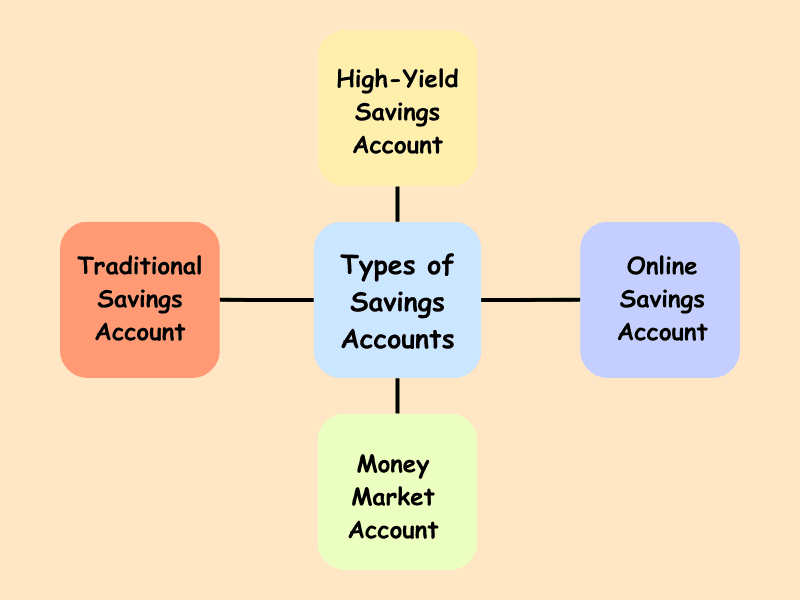

The Different Types of Savings Accounts

When it comes to saving money, there are various types of savings accounts available to choose from. Understanding the differences between these accounts can help you make an informed decision on where to store your hard-earned money. In this section, we will explore the different types of savings accounts and explain their unique features and benefits.

- Traditional Savings Account: This is the most common type of savings account offered by banks and credit unions. It typically offers a low interest rate but provides easy access to your funds. Traditional savings accounts are suitable for individuals who prioritize liquidity and want a safe place to save their money.

- High-Yield Savings Account: As the name suggests, high-yield savings accounts offer higher interest rates compared to traditional savings accounts. These accounts are often offered by online banks or financial institutions that operate solely online. While they may require a higher minimum balance or have certain restrictions, high-yield savings accounts can help your money grow faster over time.

- Online Savings Account: Online savings accounts are becoming increasingly popular due to their convenience and competitive interest rates. These accounts are offered by online-only banks or financial institutions that do not have physical branch locations. With an online savings account, you can manage your funds through a website or mobile app, making it convenient for those who prefer digital banking.

- Money Market Account: A money market account combines features of both checking and savings accounts. These accounts typically offer higher interest rates than traditional savings accounts while still providing check-writing capabilities and limited access to funds through debit cards or checks. Money market accounts are suitable for individuals who want more flexibility in accessing their funds while earning a competitive interest rate.

By understanding the different types of savings accounts available, you can choose the one that aligns with your financial goals and preferences. Whether you prioritize accessibility, higher interest rates, or convenience, there is a savings account option out there that suits your needs Absolutely! When it comes to choosing a savings account, you have several options to consider based on your specific needs and priorities.

- Accessibility: If easy access to your funds is important, you may want to look for a savings account that offers online banking or mobile app access. This allows you to manage your savings anytime and anywhere, making it convenient for your busy lifestyle.

- Higher Interest Rates: If growing your savings at a faster rate is a priority, consider high-yield savings accounts. These accounts typically offer higher interest rates compared to traditional savings accounts, helping you earn more on your deposited funds over time.

- Convenience: Some banks offer specialized saving options such as automatic transfers from checking to savings or the ability to set up recurring deposits. These features can make saving money more convenient by automating the process and helping you stay consistent with your saving goals.

Remember that different banks may have varying terms and conditions for their savings accounts. It’s essential to compare offerings from different institutions in order to find the best fit for your individual needs and preferences.

Key Factors Before Opening a Savings Account

Choosing the right savings account is an important decision that can have a significant impact on your financial goals. With so many options available, it’s essential to consider several factors before opening an account.

- One of the most crucial factors to consider is the interest rate offered by the savings account. This rate determines how much your money will grow over time. Look for accounts with competitive rates that will help maximize your savings potential.

- Another factor to consider is any fees associated with the account. Some savings accounts may have monthly maintenance fees or charges for certain transactions. It’s important to understand these fees and determine if they align with your financial needs and goals.

- Additionally, you should consider the accessibility and convenience of the account. Determine if you prefer a traditional brick-and-mortar bank or if you are comfortable using online banking platforms. Consider factors such as ATM access, mobile banking options, and customer service availability when making your decision.

- Lastly, take into account any additional features or benefits offered by the savings account provider. Some accounts may offer perks like overdraft protection, linked checking accounts, or rewards programs that can enhance your overall banking experience.

By carefully considering these factors – interest rates, fees, accessibility, and additional features – you can choose a savings account that aligns with your financial needs and helps you achieve your long-term goals effectively.

Tips and Strategies for Maximizing Your Savings Account Returns

When it comes to maximizing your savings account returns, there are several tips and strategies that can help you make the most of your hard-earned money. By implementing these strategies, you can ensure that your savings account is working for you and helping you reach your financial goals.

One effective strategy is to automate your savings through automatic transfers. By setting up recurring transfers from your checking account to your savings account, you can ensure that a portion of your income is consistently being saved without any effort on your part. This not only helps you save regularly but also prevents the temptation to spend the money before it has a chance to be saved.

Another tip is to set specific goals for saving. Whether it’s saving for a down payment on a house, an emergency fund, or a dream vacation, having clear objectives can provide motivation and focus. Break down these goals into smaller milestones and track your progress along the way. This will help you stay motivated and see tangible results as you work towards achieving them.

Additionally, consider exploring high-yield savings accounts or other investment options that offer higher interest rates than traditional savings accounts. Research different financial institutions and compare their rates to find the best option for maximizing returns on your savings.

In conclusion, by automating transfers, setting clear saving goals, and exploring higher-yield options, you can effectively maximize the returns on your savings account and take control of your financial future.

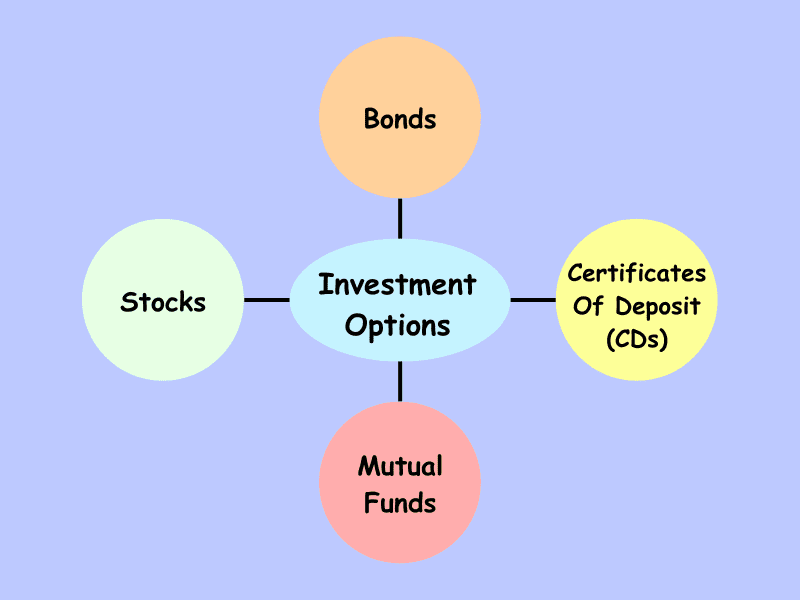

The Impact of Choosing the Right Investment Option on Financial Goal Achievement

When it comes to managing your finances, choosing the right investment option can make a significant difference in achieving your financial goals. In this section, we will explore the pros and cons of savings accounts compared to other popular investment options such as stocks, bonds, certificates of deposit (CDs), and mutual funds.

One of the key factors to consider when deciding between these investment options is your risk tolerance. Savings accounts are generally considered low-risk investments as they offer FDIC insurance and provide a stable interest rate. This makes them an attractive choice for individuals with a low risk tolerance who prioritize capital preservation over potential returns.

On the other hand, stocks offer higher potential returns but come with greater volatility and risk. Investing in individual stocks requires careful research and monitoring to mitigate risks associated with market fluctuations. Bonds also provide relatively stable returns but carry their own set of risks depending on factors such as credit quality and interest rate changes.

Certificates of Deposit (CDs) are another option that offers fixed interest rates over a specified period. They are considered low-risk investments but may have lower returns compared to other options. CD’s also have limited liquidity as early withdrawal may result in penalties.

Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals. They offer diversification across various asset classes but come with management fees and market risks.

In terms of liquidity, savings accounts provide easy access to funds without any penalties or restrictions on withdrawals. Stocks, bonds, CDs, and mutual funds may have varying levels of liquidity depending on factors such as market conditions or specific terms set by the investment provider.

Ultimately, the choice between savings accounts and other investment options depends on your individual financial goals, risk tolerance, time horizon for investing, and liquidity needs. It is advisable to consult with a financial advisor who can help you evaluate these factors and create an investment strategy that aligns with your needs.

When it comes to managing your savings account, there are certain common mistakes that you should avoid in order to maximize your savings growth. One of the most important mistakes to steer clear of is neglecting the impact of inflation rate on your savings.

Inflation refers to the gradual increase in prices of goods and services over time. If you fail to account for inflation when managing your savings, the purchasing power of your money can erode over time. This means that even though you may have a certain amount saved up, its value may diminish in real terms due to rising prices.

To avoid this mistake, it is crucial to consider the inflation rate and its impact on your savings growth. Make sure that the interest or returns on your savings account are at least keeping up with or surpassing the rate of inflation. This will help ensure that your money retains its value and continues to grow.

Additionally, regularly reviewing and adjusting your savings strategy can help mitigate the effects of inflation. Consider diversifying your investments or exploring options such as high-yield savings accounts or certificates of deposit (CDs) that offer higher interest rates.

By being mindful of inflation and taking proactive steps to address it, you can avoid one of the common mistakes when managing your savings account and optimize the growth potential of your hard-earned money.

Building a Solid Financial Future: The Importance of a Smart Savings Account Plan

In conclusion, it is clear that a smart savings account plan is essential for building a solid financial future. By taking advantage of the various features and benefits offered by these accounts, individuals can effectively manage their money, grow their savings, and achieve their long-term financial goals.

A smart savings account plan provides individuals with the opportunity to earn competitive interest rates on their savings, ensuring that their money works harder for them. Additionally, these accounts often come with convenient features such as online banking and mobile apps, making it easy to track and manage funds.

Furthermore, some smart savings accounts offer unique perks such as cashback rewards or bonus interest rates for meeting certain criteria. These incentives can further motivate individuals to save more and make the most of their financial resources.

It is important to note that while a smart savings account plan can be an effective tool for building wealth, it should be complemented by sound financial habits such as budgeting and responsible spending. By combining these strategies, individuals can create a comprehensive approach to managing their finances and working towards a secure future.

In summary, starting a smart savings account plan is a crucial step towards securing your financial future. With its numerous benefits and features designed to help you grow your wealth, this type of account can provide the foundation you need to achieve your long-term financial goals. So take action today and start building your financial future with a smart savings account plan.

Also Read: Understanding the Different Types of Retirement Accounts: A Comprehensive Guide